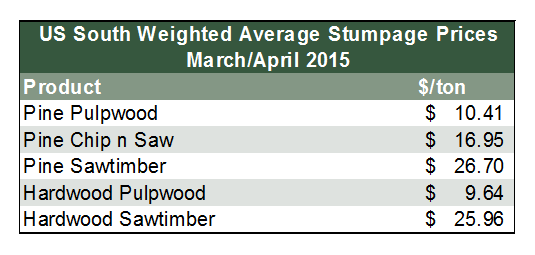

A comparison of timber prices across the South for the last 60-day period demonstrates the relative importance of location when it comes to timber prices. Southwide, for instance, in the 60-day period between March and April 2015, stumpage prices remained fairly stable, within one percentage point of the previous 60-day average.

Real differences emerge, however, when each of the three regions of the South—the East, West and Central—is compared to the Southwide average. In general, prices for smaller diameter pine logs (pulpwood and chip-n-saw) are highest in the East, while small diameter hardwood is higher in the West. The highest pine sawtimber prices can be found in the West, while the highest hardwood sawtimber prices can be found in both the Central and West regions.

East

Timber markets along the southeastern coast are dominated by supply that is primarily pine plantation and demand from a combination of pulp and paper mills, oriented strand board mills, small log sawmills and pellet manufacturers. As a result, markets in the East tend to favor smaller diameter pine timber, and pricing of these products reflects this.

In the last 60 days, for instance, pine pulpwood prices have been 131 percent of the Southwide average during the March/April period, and pine chip-n-saw prices have been 111 percent of the Southwide average. Pine sawtimber prices are slightly above average, at 102 percent. Because there is not a robust hardwood market in the region, however, hardwood prices have decreased in the region, with pulpwood at 87 percent of the Southwide average and sawtimber at 88 percent.

West

Timber markets in the West, by contrast, are dominated by supply from natural stands and demand from competitive hardwood-consuming pulp and paper mills and large diameter sawmills taking both pine and hardwood. While harvests of pine outpace hardwood harvests in the region, hardwood prices tend to be higher. High competition for hardwood pulpwood drives prices higher, and high quality, large-grade hardwood sawtimber growing in natural stands commands a premium over basic mixed grade sawtimber.

Hardwood pulpwood prices are highest in the West at 126 percent of the Southwide average as a result. Hardwood sawtimber prices are roughly equivalent to the Central region price at 106 percent of the Southwide average. Pine sawtimber prices are the highest in the West at 108 percent of the Southwide average. Pine chip-n-saw prices are at 94 percent of the average, and pine pulpwood prices are at 89 percent.

Central

In the central part of the South—Mississippi, Alabama, and the western portions of Georgia and South Carolina—location is even more important. In the northern portion of the region, natural hardwoods are much more common. The southern section of this region—because it is a coastal plain—tends to have more in common with the East region, however. Because of the divided nature of this region, having a region-wide price is more a way to follow trends than it is to understand pricing.

In fact, hardwood sawtimber is the only product class whose price is above the Southwide average at 106 percent. Hardwood pulpwood prices ended the period at 87 percent of the average. Pine sawtimber prices are at 90 percent of the average, while pine chip-n-saw prices are at 95 percent and pulpwood prices are at 80 percent.

--

Timber prices are very location-specific. Any combination of supply and demand factors—whether they are related to weather, rotation schedules, new or closed capacity at a mill, or even the ability of mills to substitute one raw material for another—can have significant impacts on pricing, even between contiguous counties. The differences in pricing between these broader regions illustrate just how substantial the disparity can be.

Joe Clark

Joe Clark