2 min read

2022 Closes with Continued Drops in US Forestry Industry

Forest2Market

:

January 17, 2023

As 2023 gets rolling, we’re taking a look back at the tumultuous year we’ve left behind. How did 2022 wrap up in terms of performance and economic indicators in the US forest industry?

Below, we've collected key December insights from the Institute for Supply Chain Management (ISM) and the US government. You can find more in our monthly Economic Outlook publication, one of our many forest industry analytics and forecasting products.

Overall Industrial Production with Good News in Utilities

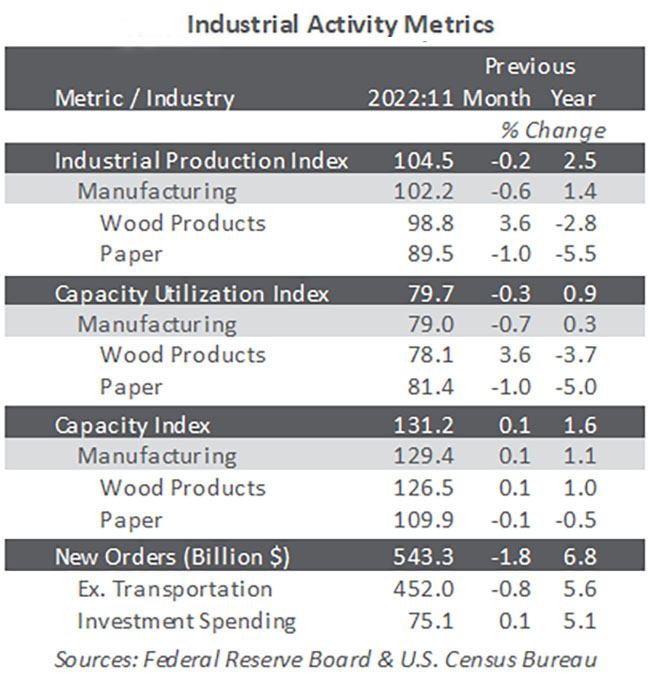

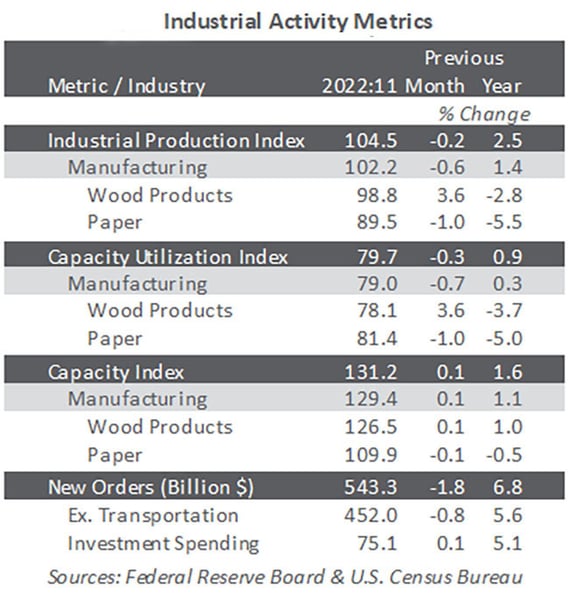

As the below table shows, total industrial production (IP) declined 0.2% in November (+2.5% year-over-year). This is the largest month-over-month slowdown since September 2021. It's following the same downward trend we saw in October's US forest industry IP.

Decreases of 0.6% for manufacturing and 0.7% for mining were reported, most notably in motor vehicles. This drop was partly offset by a rebound of 3.6% for utilities following three months of declines. New factory orders decreased 1.8%, while business investment spending edged up by 0.1%. This marks a 5.1% increase year-over-year (YoY).

We are forecasting quarter-over-quarter changes in total industrial production to range between ‑4.0% and +3.1% annualized rates while averaging +0.5% over the next 24 months.

ISM Survey Shows Drop

The Institute for Supply Management’s (ISM) monthly sentiment survey of US manufacturers for December 2022 contracted further. The PMI registered 48.4%, down 0.6PP from November’s reading. FYI, 50% is the breakpoint between contraction and expansion.

Activity in the services sector followed manufacturing into contraction (-6.9PP to 49.6%). This indicated another recession warning.

S&P Global Survey Ends Weak for 2022

Changes in S&P Global’s survey headline results were consistent with those of ISM. 2022 showcased a relatively weak overall performance. There was a reduction of both new orders and outputs occurring at a slightly steeper level than prior months.

S&P Global’s Siân Jones noted that the decreased performance came in the wake of lower demand for goods in both domestic and export sales. The resulting conditions further cascaded across the months since the earlier pandemic levels.

Consumer and Producer Indices on the Rise

Beyond the decreases, it’s not all bad news in terms of economic forecasts. The consumer price index (CPI) rose 0.1% in November after increasing 0.4% in October. This reflects a 7.1% increase year-over-year.

The index for shelter (+0.6%) was by far the largest contributor to the monthly all-items increase, more than offsetting decreases in energy indices. The food index increased 0.5% month-over-month. The energy index decreased 1.6% month-over-month as the gasoline, natural gas, and electricity indices all declined.

Meanwhile, the producer price index (PPI) advanced 0.3% (+7.4% year-over-year). The raise here was on par with both October and September.

Most of November’s month-over-month increase is attributable to a 0.4% advance in prices for final demand services. It was led by an 11.3% rise in securities brokerage costs.

The index for final demand goods inched up 0.1% thanks to a 38.1% jump in the index for fresh and dry vegetables.

Spotlight on Forest Products Sector

Zooming the lens in on the forest products sector, we see a mixed bag of numbers. For the most part, however, year-over-year performance has improved.

Here are the price index specifics for forest products:

- Pulp, Paper & Allied Products: +0.2% (+9.2% YoY)

- Lumber & Wood Products: -1.4% (+3.5% YoY)

- Softwood Lumber: -0.9% (-3.9% YoY)

- Wood Fiber: 0.0% (+4.7% YoY)

Insights at a Glance with Forest2Market’s Economic Outlook

Forest2Market, a ResourceWise company, offers a monthly Economic Outlook (EO) forecasting report for businesses across the forest industry supply chain. The information presented in this post was drawn directly from January’s EO.

The Economic Outlook goes beyond what’s presented here by offering critical information about the forestry industry and broader economic data and indicators. This helps our subscribers to make better strategic decisions in all the following ways:

- Identifying changes and performance indicators

- Enhancing focus on market drivers

- Improving decisions with benchmarks and critical data

Learn more about the Economic Outlook by following the link below.