If we’ve learned one thing about economic uncertainty during the COVID-19 pandemic, it’s that markets will always react to demand regardless of the conditions. As tissue & towel manufacturers have demonstrated over the last several months amid record demand, many businesses simply don’t have time to wait for what amounts to a subjective sense of certainty.

The solid wood sector was hit especially hard early in the pandemic due to slowed construction, primarily in states that deemed it to be non-essential. In April, primes sold better via the big box stores, but demand for construction-grade products was near anemic.

Mill curtailments are still in place across the continent as the lumber industry, like many other industries, has made adjustments to the “new normal.” But as state economies open back up and new-home construction resumes, the sudden surge in demand has caught many lumber purveyors off-guard and prices have skyrocketed as a result.

Southern Yellow Pine:

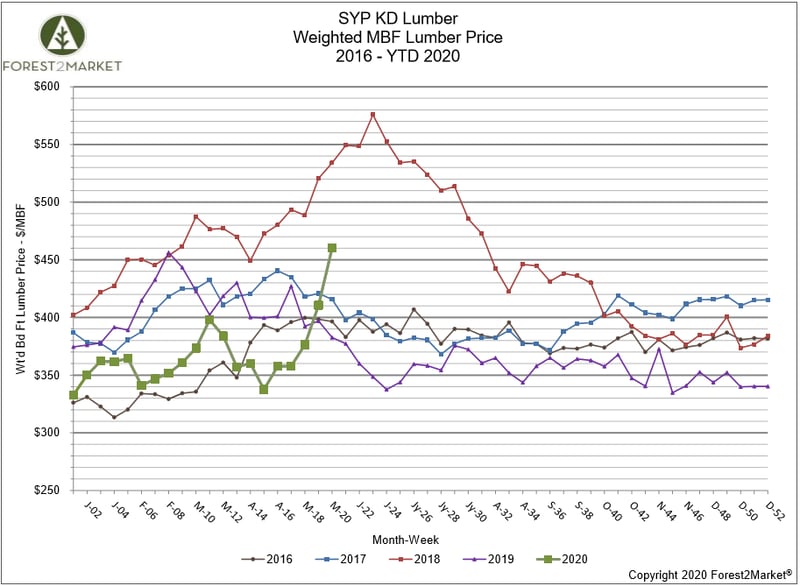

Building on two weeks of significant increases, southern yellow pine (SYP) lumber prices skyrocketed in mid-May to their highest level in nearly two years. Forest2Market’s composite SYP lumber price for the week ending May 15 (week 20) was $460/MBF, a 12.2% increase from the previous week’s price of $410, and a 20% increase from the same week in 2019. The last time the composite SYP price was this high was in July 2018, when prices began to recede from record highs achieved in June. Here’s a look at SYP price trends thus far in 2020:

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price (to date): $380/MBF

- YTD Average Price: $367/MBF

Based on the price performance of these benchmark products, there is clearly demand for North American lumber in the current market. But is this an indication of things to come?

Near-Term Outlook

It’s really difficult to predict what the housing market – the principal driver of lumber demand - will do in the near term. The NAHB/Wells Fargo Housing Market Index (HMI) reflects builders’ reactions to the virus-related shutdowns, and the HMI plunged 42 points in April (to 30), the largest single monthly change in the history of the index. It marks the lowest builder confidence reading since June 2012, and it is also the first time the index has been below 50 since June 2014.

Housing demand is tied to employment and unemployment has surged over the last six weeks. The current unemployment rate is nearing 15 percent (the highest since the Great Depression era) and, while a bulk of those layoffs will be temporary, there will likely be some structural changes going forward that will result in higher unemployment numbers than we have seen over the last two years.

Lingering effects of this pandemic-driven financial crisis are also looking increasingly probable. We’re simply not going to be able to lift the restrictions, snap our fingers and go back to the way things were in January; a well-defined “V”-shaped recovery is looking less and less likely at this point.

Neel Kashkari, President of the Minneapolis FED, recently said that "The V-shaped recovery is off the table” during a virtual roundtable conversation. As MarketWatch noted, “Kashkari said the recovery would likely be long and drawn out. While there will be a bounce after the worst GDP contraction in the April-June quarter, the economy will be ‘nowhere near back’ to where it was in December 2019, he said.”

The good news for lumber manufacturers in the interim is that demand is still there. And judging by recent performance, it is poised to outpace supply in the very near term, especially as more and more state economies are coming back to life. The challenge for manufacturers in the coming months will be adequately matching their production to demand while maintaining margins in a highly fluid market.

Joe Clark

Joe Clark