We addressed this common question last year as oil prices began trending up in late 3Q2021. And while the answer is “no” under normal circumstances, we’re now dealing with a confluence of economic and geopolitical conditions that are anything but normal.

Historically, the supply and demand of logs and wood fiber is ultimately what drives the price of these products on the market, which is independent of fuel price. However, the cost of producing logs and fiber is not independent of fuel price, or the price of any other input that goes into generating these products; steel, labor, tires, oil, etc. all affect the cost of producing forest products.

As we noted last month, these costs in combination with pinched trucking capacity have driven freight prices for mill deliveries higher in the Northeast. And worries over global energy markets and future trade flows are now exacerbating the issue.

Oil Market Snapshot

The monthly average US-dollar (USD) price of West Texas Intermediate (WTI) crude oil pushed higher (by $8.42 or +10.1%) to $97.13 per barrel in late February. Although the invasion of Ukraine did not officially begin until Feb. 24, throughout the month oil prices were reacting to the rising geopolitical tensions. In addition, the inability of some OPEC+ members to boost production despite increased demand further contributed to tight markets.

Looking forward, oil’s price trajectory will depend at least in part upon how effective sanctions on Russia prove to be in shortening the conflict. However, its central bank has been sanctioned, several banks have been cut off from the SWIFT transaction system, and further restrictions on new debt and equity are being imposed. While the United States initially refused to cut imports of Russian oil (671,000 barrels per day in 2021), there is a prospect of some 4.7 million BPD of crude flows (Russia’s average crude exports YTD) being sealed off if the war drags on.

In an attempt to blunt some of the impact of sanctions, the White House has partially shelved its animus against the fossil energy industry and quietly asked US producers to increase output; the Biden administration has also more openly pled with regimes like Venezuela and Saudi Arabia to boost production. Given the conflicting crosscurrents, “Uncertainty remains rife in oil markets and the price of WTI is soaring,” OilPrice.com’s Tom Kool wrote.

Delivered Wood Price Snapshot

Regional wood prices have also been volatile over the last year. For instance, log prices in the South are now at a 14-year high amid strong demand from southern sawmills, and wood chip prices in the Pacific Northwest (PNW) have soared in recent months as limited timber availability squeezes suppliers on both sides of the US/CAN border.

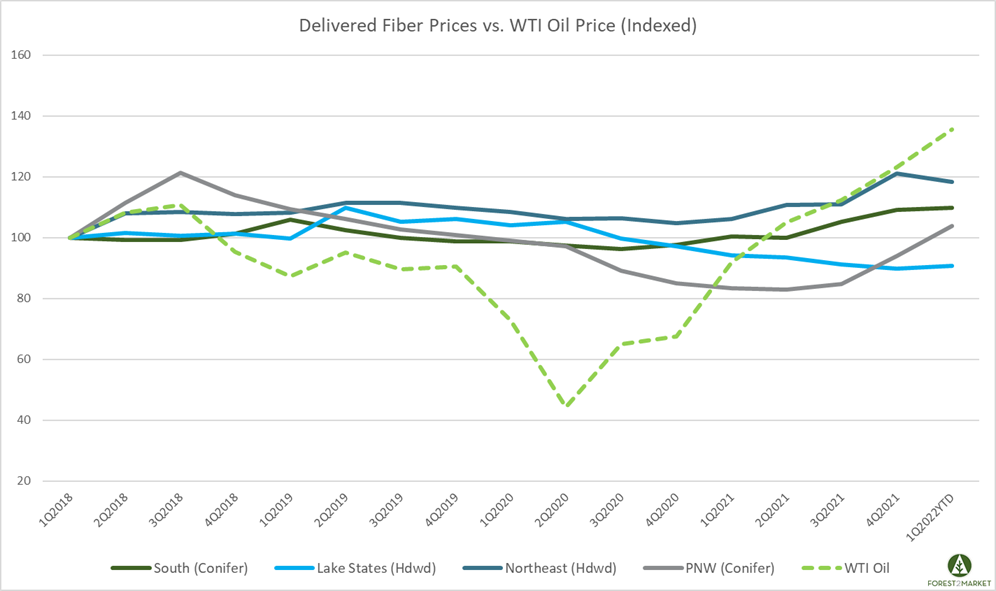

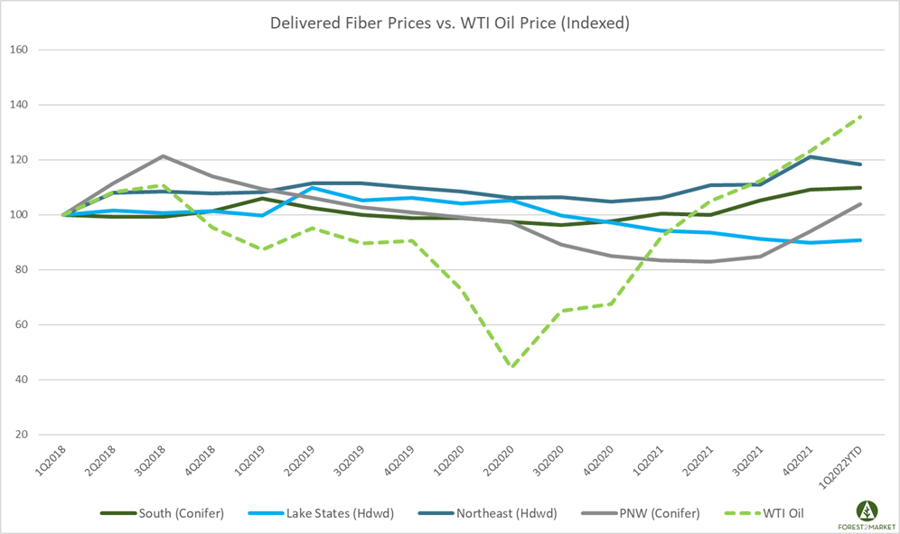

To get a picture of WTI oil price performance compared to delivered wood fiber price performance across the US, we indexed weighted average delivered regional prices along with weighted average WTI oil price to get a fair, but broad, representation of these products on a quarterly basis. (The chart below illustrates a total change in price as a percentage, not a change in actual dollars.)

Note the largely independent trends between regional delivered fiber prices and WTI oil price over the last two years. After bottoming in 2Q2020, oil price has surged quarter-over-quarter (QoQ) since the peak of lockdowns. While the increases haven’t been nearly as acute, quarterly delivered fiber prices have largely trended higher as well - with the exception of the Lake States. This is not surprising, however, as two large mills in Wisconsin Rapids, WI and Duluth, MN were both shuttered, and many other mills in the area curtailed production in the wake of the 2020 lockdowns. This resulted in the permanent removal of over 1.5 million tons of (what had been) stable hardwood demand from the region, and fiber prices have fallen in response.

Will Soaring Energy Prices Eventually Impact Delivered Wood Costs?

Per the American Trucking Associations, the US was short 60,000 drivers in 2019 and that number is anticipated to increase to 100,000 by 2023. And as Forest Resources Association noted in January, supply chain pinches across the transportation sector are having a real impact on prices of almost everything, including delivered wood fiber. The challenges outlined in these instances are compounding, and an increase in freight costs is therefore not surprising:

- A trucking company that hauls raw forest products domestically as well as to and from Canada has experienced significant increases in costs over the past year. Labor has increased 25% and diesel fuel 50%. Trailers and tractors are taking more than six months to receive. This company will additionally be impacted by the vaccine requirement for drivers hauling forest products to and from Canada to the US. The company anticipates losing more than 50% of its drivers that haul products to Canada due to the vaccine requirement which were implemented in early 2022.

- A logging and trucking company located in Minnesota has been waiting for parts to fix road building equipment for more than two months. Trailers to haul logs were ordered more than six months ago and still have not been received. New trucks ordered today are more than one year out. Maintenance items subject to wear, such as saw blades and saw bits, are more than three months out.

- A logging business in the Northeast US has been waiting for parts to fix in-woods equipment (skidder) for two weeks. The business owner has been told that the part, normally available locally, is on a shipping container off the Port of Los Angeles. This delay will result in a significant loss of timber production during the busy winter harvest season.

So, all of the independent drivers that go into the cost component we broadly identify as “freight” are increasing for a number of reasons, which will continue to apply upward price pressure on all supply chains. Despite escalating freight prices, it’s still inaccurate to say that higher WTI prices are solely responsible for the increases.

In the case of the Northeast, there is an additional transportation-related dynamic that could be impacting delivered prices: Average haul distance in the region is nearly 100 miles, while average haul in the US South is about half of that. This extra mileage adds up and impacts the freight cost component that contributes to total delivered costs in the Northeast.

Margins Drive Process Improvements

Forest2Market is in the business of helping companies make better operational decisions through the application of unique, proprietary datasets that drive efficiency improvements and profitability. To assist in this process, we benchmark price to help our customers manage their supply chain costs, including freight costs.

The national average price of pump diesel is currently $5.05 per gallon - a 63% YoY increase. While there is cause for concern about America’s squeezed trucking capacity and skyrocketing energy costs, markets have a way of overcoming temporary challenges; there are always savings opportunities in the forest supply chain. Identifying these opportunities with Forest2Market’s transaction-based data leads to business improvements that drive increased profitability.