In November 2017, we published a comprehensive analysis covering the Northeast and Appalachia that illustrated the large increase in hardwood log and lumber exports from those regions that were going to China, and the downward trend recorded for exports headed to other countries. A mere two years later, we are witnessing just how fast international markets can change.

Significant challenges have plagued the North American hardwood industry since that analysis was published, and the dramatic shift in export trends and fiber demand has impacted the entire supply chain. As a follow-up to our recent coverage of this market, we performed an updated analysis that helps to uncover some of the key areas impacted over the last 17 years, which helps us intuit some general understanding on the direction of the hardwood export market.

Different Markets, Different Analyses

Our original analysis included full-year information from 2005 through 2016 and annualized data for 2017 based on January through September actual data. Information for the entire US, the Northeast regions and the specific four northeast Appalachian states (NY, OH, PA & WV) was presented. These breakdowns were used since about a third of US hardwood log and lumber exports originated in the Northeast and the four Appalachian states accounted for roughly 80 - 90 percent of the exports from the that region. The analysis also illustrated the large increase in US hardwood log and lumber exports to China and the downward trend recorded for exports to other destinations.

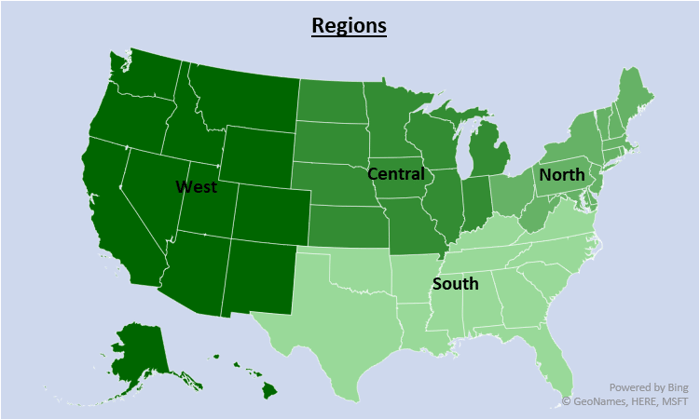

To gain a broader understanding about this market on a national level, the new analysis expands across the four regions shown on the map below rather than concentrating on the Northeast and the specific Appalachian states. For a more comprehensive view, the new analysis also covers exports beginning in 2002 through an annualized estimation for 2019 (based on January through August actuals). The harmonized system (HS) codes used in this analysis are the same as those used in the original 2017 research.

- Hardwood Logs: HS codes - 440391, 440392, 440399

- Hardwood Lumber: HS code – 440791, 440792, 440793, 440794, 440795, 440799

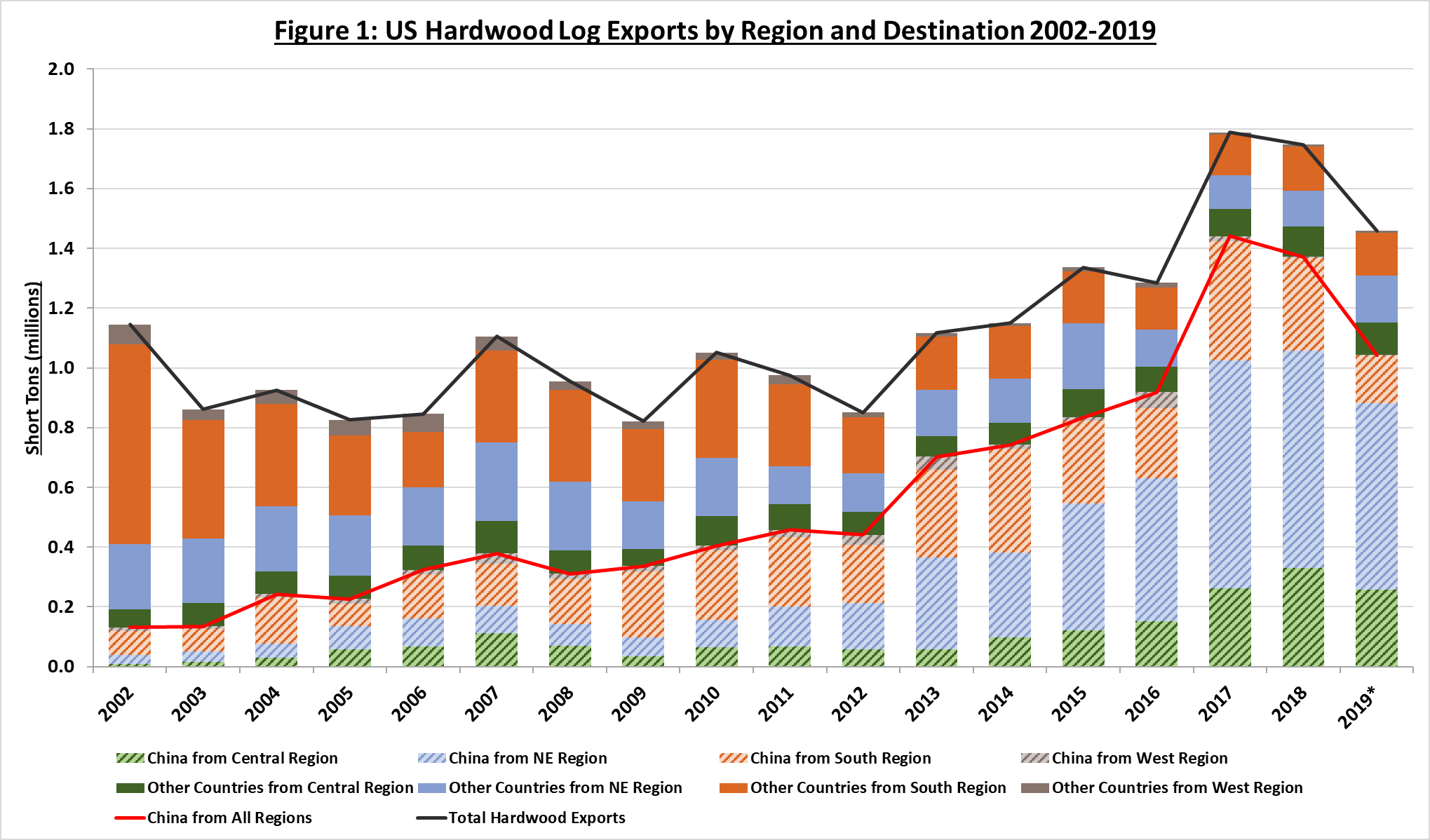

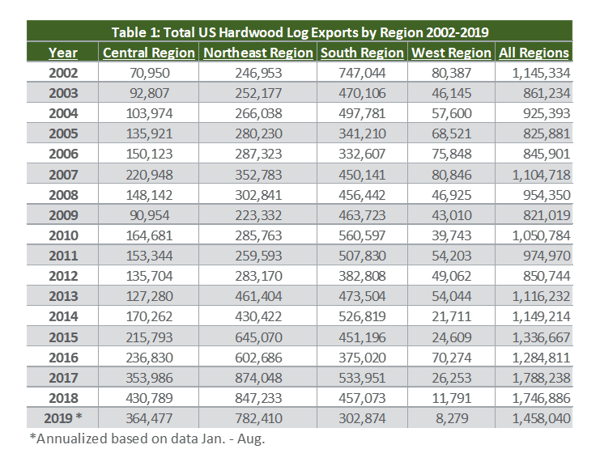

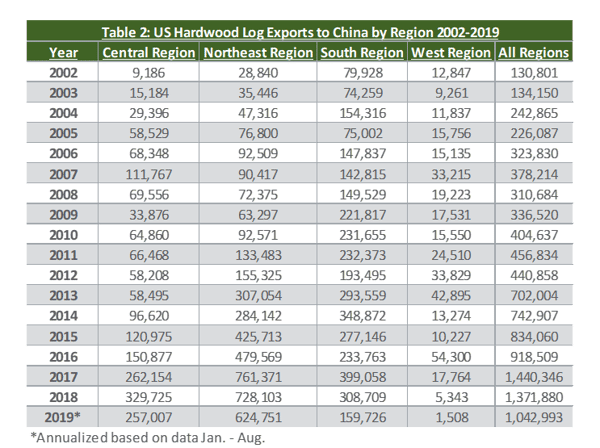

Hardwood Log Exports

As circumstance would have it, total US hardwood log exports peaked in 2017 at almost 1.8 million tons as shown in Table 1. In that year, the Northeast accounted for the lion’s share of exports. Table 2 illustrates US hardwood log exports directly to China over that same time period. While Table 1 demonstrates limited yearly volatility, Table 2 really illustrates how China has driven the hardwood log export market over the last 17 years. To put the trend in perspective, hardwood log exports to China in 2002 were just 11 percent of total US shipments; like total hardwood log exports, shipments to China also peaked in 2017 at over 1.4 million tons—roughly 82 percent of total US shipments.

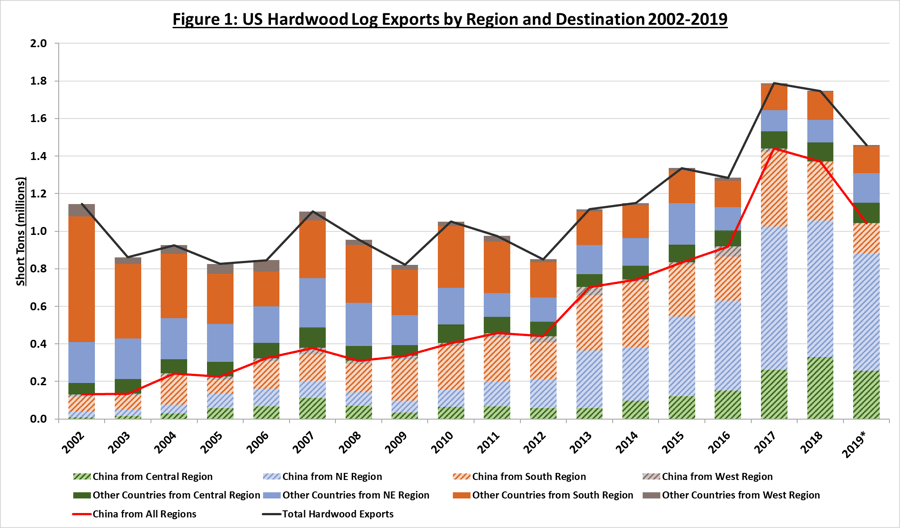

Figure 1 illustrates just how important China has become as the primary importer of American hardwood logs over the last 17 years. The area under the red line represents exports to China and the black line indicates total exports. It is also easy to see the decline in hardwood exports to countries other than China, which is represented by the area between the black and red lines.

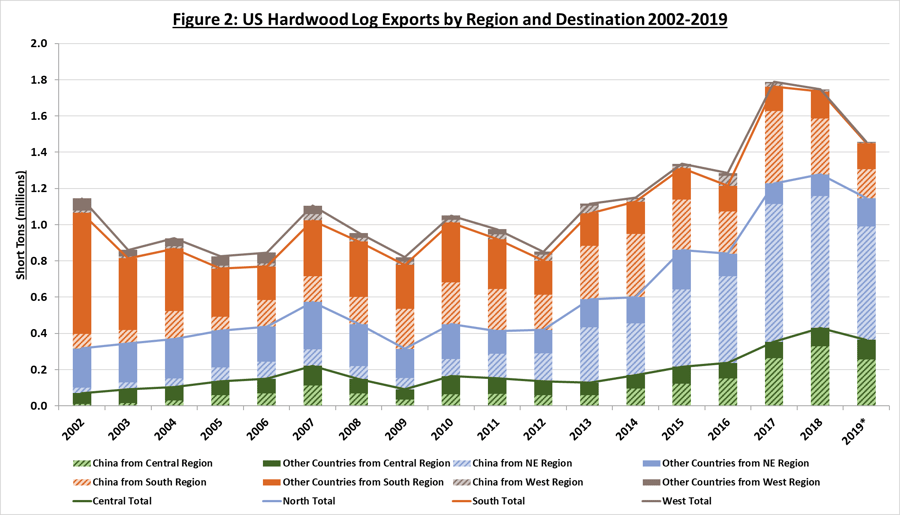

Figure 2 illustrates the same information, only graphically presented in an altered order to better illustrate the regional trends. Hardwood log exports from both the Central and Northeast regions have increased over the study period while those from the South and West regions have declined. This chart also helps visualize the tremendous increase in exports to China from the different regions.

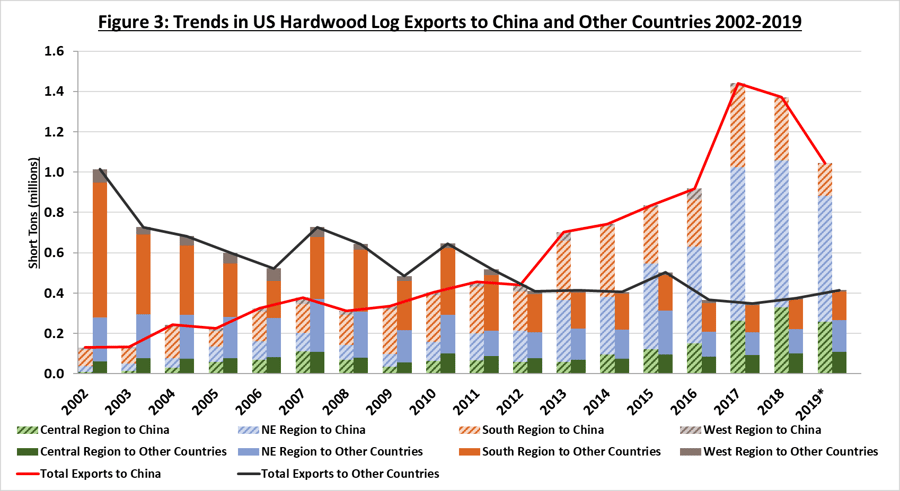

Figure 3 helps to visualize another representation of the same hardwood log data to better illustrate the dynamic trends between exports to China versus exports to other countries over the study period. In 2002, exports to China were only a small portion that gradually climbed to comprise half of all exports between 2011 and 2012, and finally peaking in 2017. While hardwood log exports to China have fallen off significantly in the last two years, there has been a slight uptick in exports to other countries.

Hardwood Lumber Exports

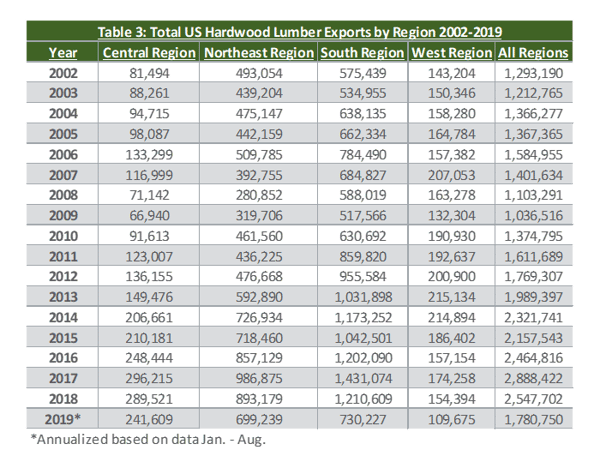

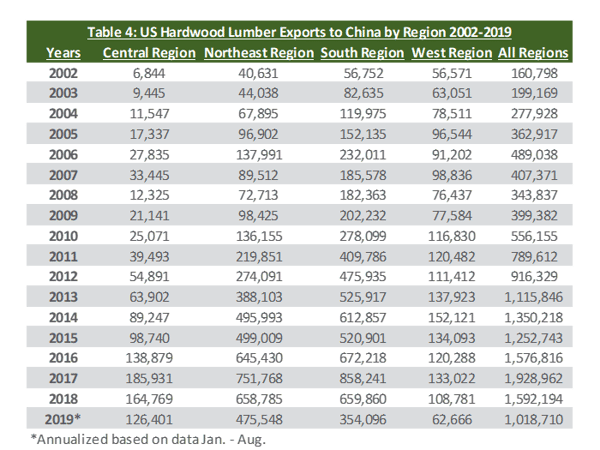

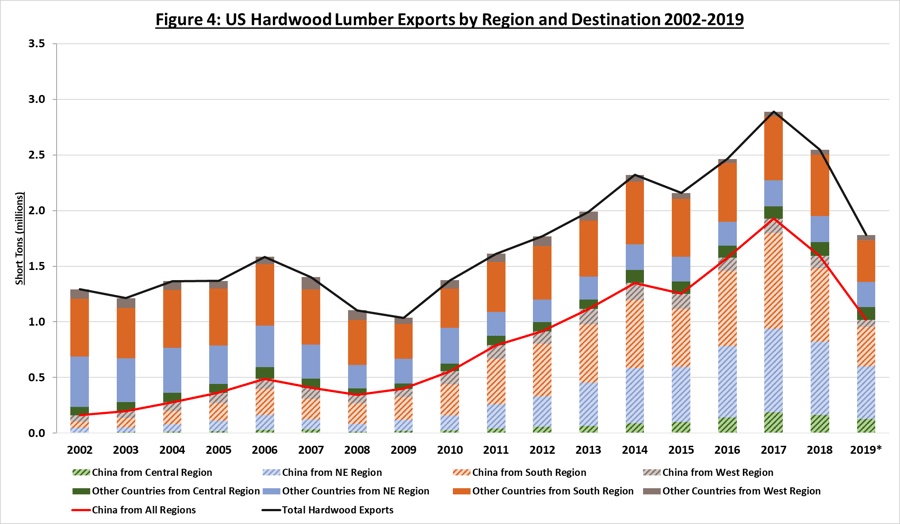

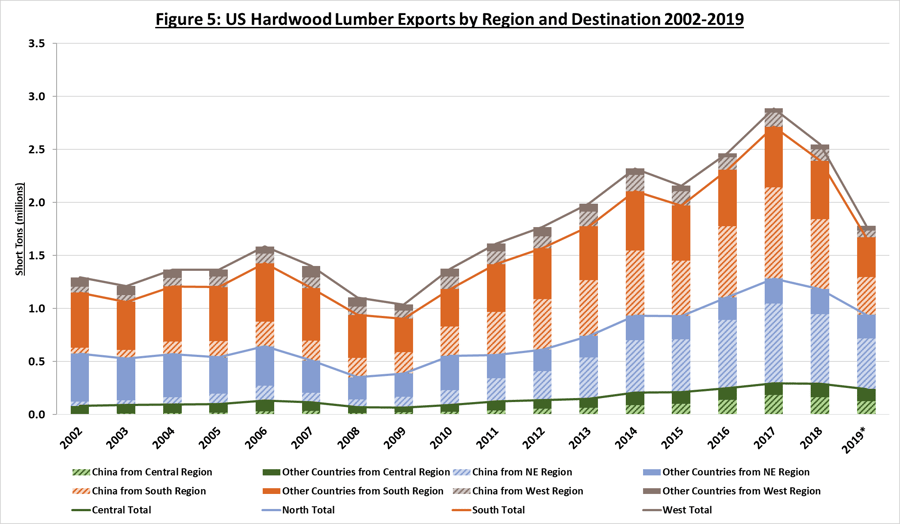

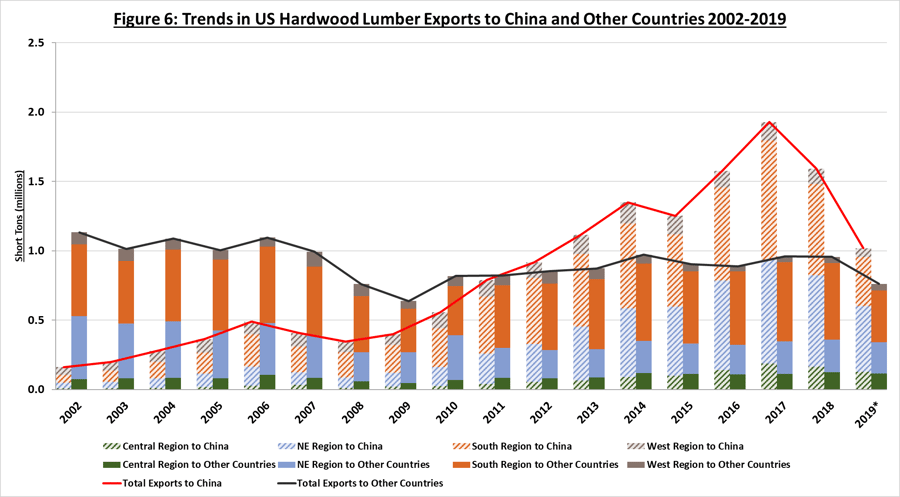

Like hardwood log exports, total US hardwood lumber exports also peaked in 2017 at almost 2.9 million tons as shown in Table 3. Table 4 illustrates US hardwood lumber exports to China over the study period and like log exports to China, hardwood lumber exports also peaked in 2017 at over 1.9 million tons. To put the trend in perspective, hardwood lumber exports to China in 2002 were just 12 percent of total US shipments; however, by 2017, shipments to China were roughly 67 percent of total exports.

The decline in hardwood lumber exports to China over the last two years is more accentuated than the decline in hardwood logs. Projected 2019 hardwood lumber exports to China are expected to be around 57 percent of total US lumber exports.

The significant increase in hardwood lumber exports to China from 2002 - 2017 is depicted in Figure 4 by the area under the red line (the black line indicates total hardwood lumber exports). Beginning in 2018, the decline in hardwood exports to countries other than China is represented by the area between the black and red lines.

Figure 5 includes the same information that is graphically presented in an altered order to better illustrate the regional trends. Total hardwood lumber exports from the Central, Northeast and South regions have increased while those from the West have declined.

Figure 6 is a better representation of hardwood lumber export trends to China compared to exports to other countries. In 2002, exports to China were only a small portion that gradually climbed until 2009 when hardwood lumber exports increased rapidly and reached half of total shipments by 2011. The precipitous climb lasted until the peak in 2017. However, hardwood lumber exports to China and other destinations have fallen off significantly in the last two years, though the decrease in exports to China is more pronounced.

Conclusion & Outlook

While our first analysis of hardwood exports concentrated on the Northeast and the four Appalachian states due to the increased demand occurring at that time, the new analysis uncovers some noteworthy findings.

- The visual data in this report illustrate that the South makes up a significant portion of the American hardwood export market, especially for lumber. Since peaking in 2017, hardwood lumber exports have decreased more rapidly than have hardwood log exports.

- China’s large influence on the hardwood export market has been progressive over the study period and became particularly pronounced in 2011. The trend reversal in 2018 and the decreases in both hardwood log and lumber exports to China are noteworthy. The ongoing trade dispute and tariffs have played a large part in this trend reversal, particularly in 2019. China’s economy is slowing, however, which could impact future American hardwood demand.

- Hardwood exports to destinations other than China have largely followed a similar trend, though the decreases have been less dramatic. This suggests some relative softness in the global hardwood market, which will create challenges for exporters seeking to better compete in existing markets or enter new markets.

- If a long-term trade deal with China is reached in the coming months, we expect to see a significant rebound in American hardwood exports. While it will take time to see a trend reversal play out in both the supply chain and the export data, the US hardwood industry is positioned to react quickly to market signals.

Most importantly, this analysis should help to alleviate some of the concern that many hardwood producers have about the long-term state of the market. While certain regions have fared better than others during the face-off with China, the data above illustrates that hardwood log and lumber exports are still high compared to recent history. We are not even two years removed from the high point of 2017, which makes the current decline seem all the more pointed. However, the export volumes of both hardwood logs and lumber have soared over the last 17 years, and they are still significantly higher in 2019 than they were 10+ years ago.

Certainty remains in short supply these days but on this point, I am certain: The US is home to the most abundant, sustainable supply of high-value, top-quality and diverse hardwood products in the world. While the industry is not immune to market fluctuations, demand for American hardwoods remains strong. The data in this analysis suggests there is every reason to believe that a lift in demand will return once a long-term trade solution is reached, providing a level of assurance to the market.

Note: Short ton is the reported measurement unit used in the US Census Bureau data base. However, hardwoods are generally measured in terms of board feet. As rough approximations to board feet, logs can be converted using 6.5 ton/mbf and lumber using 1.67 ton/mbf. Using those factors for the 2017 peaks would place hardwood log exports at slightly over 275 million board feet and hardwood lumber at about 1.73 billion board feet.