The forest products industry—which typically flies under the public radar—has been making headlines since the COVID-19 pandemic struck in 1Q2020. The pulp & paper sector was top-of-mind during the widespread run on toilet paper that took place from March through June, and the lumber sector has been front-page news in recent weeks as prices for finished lumber set new records by huge margins.

While the new attention is beneficial in helping to illustrate the complexities of the forest supply chain, those of us close to the industry have wondered the degree to which COVID-19 lockdowns have impacted the forest supply chain.

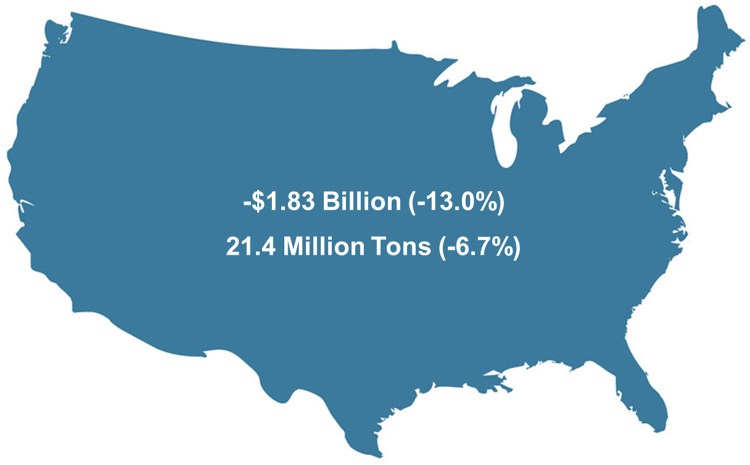

Forest2Market was recently commissioned by the American Loggers Council (ALC) to identify just how significant these impacts have been. Forest2Market research found that US raw wood material consumption between January-July 2020 was 6.7% less than the same period in 2019 – dropping by 21.4 million tons of material. This resulted in a 13% reduction ($1.83 billion) in value of the delivered wood.

COVID-19 Impacts to Delivered Wood Raw Material

Beyond the national data, participants in the supply chain are now asking a series of questions related to their own regions and sectors: Were there noticeable trends in demand for individual forest products? How have they affected supply and price? What can manufacturers learn from this event to help improve responsiveness should something similar happen again?

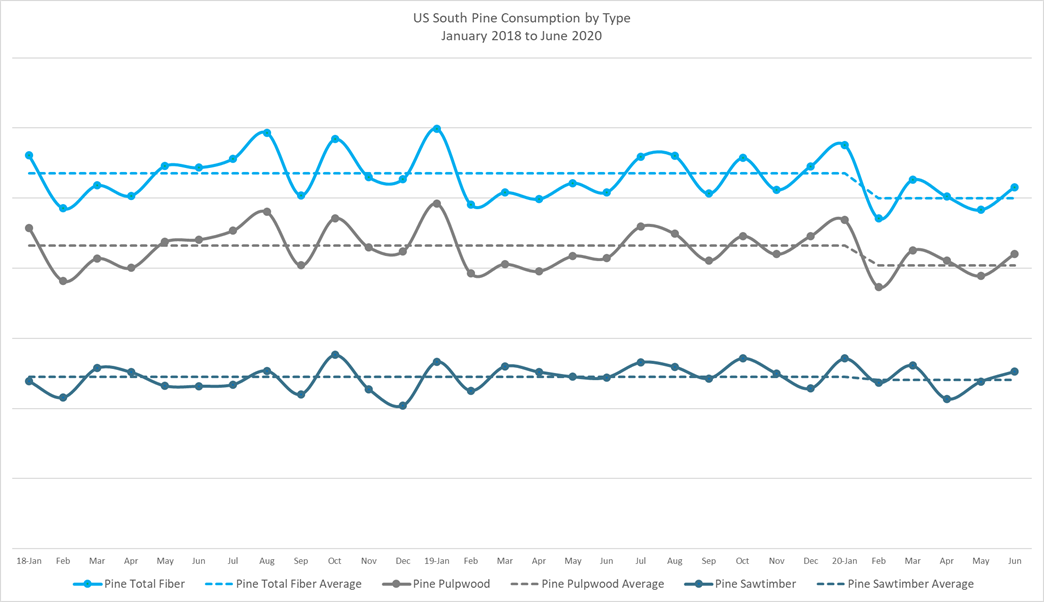

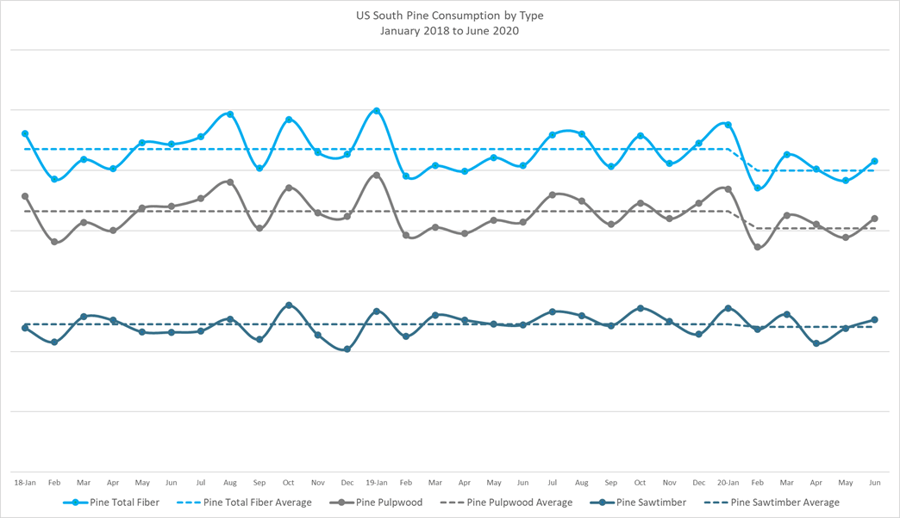

Using Forest2Market’s proprietary data, I chose to analyze consumption (harvests and deliveries) of wood raw materials in the US South over the last two quarters as a marker for demand, which should give us a clear view into the drivers of the southern wood supply chain during the peak of the pandemic. The data indicates that the effects of COVID-19 began to impact the supply chain in February, and they continued well through June (and likely into July).

At a high level, the most noteworthy trends were:

- Pine total fiber (pulpwood, primary chips, secondary chips) deliveries dropped by about 7% during the February through June period.

- Hardwood total fiber dropped by over 20%, but the total volume makes up a much smaller part of the industry in the South.

What does a deeper dive into the product data illustrate about the current state of the market?

Pine Data Trends

Pine sawlog consumption remained largely unchanged from February through June, which seems counterintuitive on the surface. While there were some sawmill curtailments, during April/May, the net effect simply wasn’t enough to materially impact regional demand for pine sawtimber. While sawlog deliveries did drop in April, they rebounded by May/June and sawmillers currently can’t cut enough boards to keep up with insatiable market demand.

Like pine sawtimber, our data show that pine secondary chip deliveries remained largely unchanged from February through June. High production at sawmills has resulted in a robust supply of secondary chips on the market, which has kept downward pressure on price. It is also worth noting that deliveries of pine primary chips have been trending down since 2018, so it is difficult to attribute any decrease during 1Q and 2Q2020 directly to COVID-related impacts.

The data tell us that most of the volume that came out of the system in 1Q and 2Q2020 was in the form of pine pulpwood. This decrease in deliveries and thus harvesting has added roughly 2 million tons of pulpwood to an already healthy volume of standing inventory. This volume will also continue to grow and drive prices lower in the near term unless there is a rebound in consumption post-pandemic that is significantly above the pre-pandemic average.

Hardwood Data Trends

Unlike pine products, the overall demand trends for hardwood products were significantly lower in almost every category. While demand (and price) for hardwood sawtimber remained steady from February through June, this makes up a very small portion of the overall market in the South. However, demand for hardwood primary chips tanked as deliveries decreased by 25%, deliveries of hardwood secondary chips dropped by 15%, and deliveries of hardwood pulpwood dropped by nearly 20%.

Three large southern mills in the pulp and paper segment curtailed production due to COVID-19, which helps to explain the decrease in consumption. The remaining hardwood pulpwood consuming facilities were then hit by the precipitous drop in demand for office paper and other printing and writing papers, as lockdowns across the country kept students—and, in many cases, their working parents—homebound. As a result, COVID has accelerated the decline of these segments in the pulp and paper industry.

Outlook

February 2020 marked the beginning of a discernable decreasing trend in regional consumption of southern wood products, which reflects an overall decrease in demand. Consumption has vacillated since February, but the variability is not out of line with historical patterns.

It’s worth noting that we did see a similar drop in wood products deliveries in early 2019; however, this was caused by prolonged periods of wet weather that actually drove delivered prices significantly higher as mills searched hard to fill their inventories. The primary difference between what occurred then and what is unfolding today is that early 2019 was driven by challenging supply issues (increasing price), and the current market is being driven by a continued decrease in demand from the pulp and paper sector (decreasing price).

The price of pine total fiber had been trending down since early 2019, but it flattened in late 2019/early 2020. Based on the data from February through June 2020, as well as the current state of the market, any decrease in pricing will likely come out of logger/dealer margin in the near term, and then trickle down to stumpage prices in the longer term.

High lumber prices continue to drive lumber production and consumption of sawlogs that has remained largely unchanged since early 1Q. This could result in some supply issues if the imbalance between pine pulpwood consumption and log consumption continues.

We will explore the data for other regions throughout the US in the coming weeks – stay tuned.

Pete Coutu

Pete Coutu