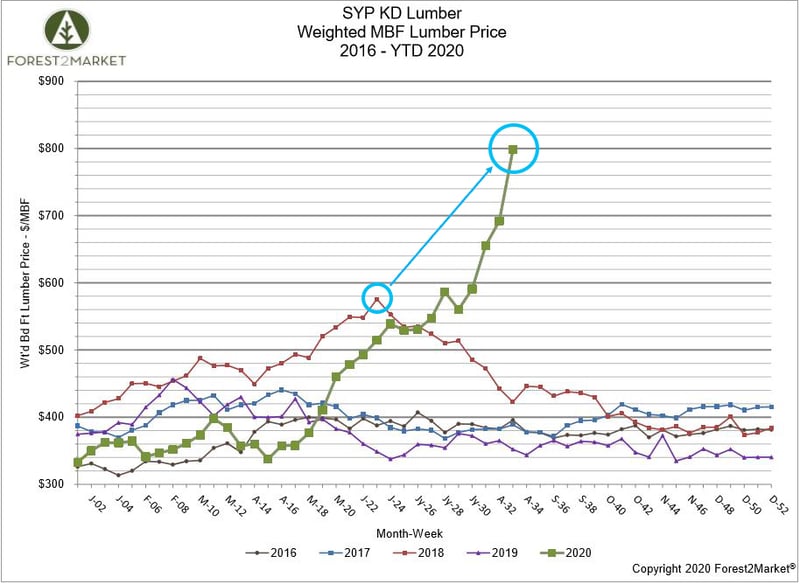

After three consecutive record-breaking weeks, southern yellow pine (SYP) lumber prices once again pressed on to set a new record—by a big margin. In mid-August, Forest2Market’s SYP lumber price composite showed prices jumped $106 in just one week. To put the new number in perspective, the composite price for the week ending August 14 was $798/MBF, which represents a 39% increase over the previous all-time high of $576/MBF that was achieved in June 2018.

The North American sawmill supply chain is under a lot of pressure; industry capacity is maxed as wholesalers and distributors snatch up every board they can find, and the trend is not unique to the South.

Such a price run also prompts the obvious question: What market fundamentals drive lumber prices?

- Housing starts: Historically, the main driver of lumber prices has been the larger US housing market, which requires a well-oiled supply chain, steady import flows (primarily from Canada) and massive amounts of finished lumber, plywood, oriented strand board (OSB) and other building materials.

- Lumber inventory: The market’s capacity to produce lumber is the other key factor that drives price. Manufacturers must be able to make and stock a number of specific products and grades in order to meet the demands of the huge construction market.

What’s Driving Record Lumber Prices Now?

Lumber prices have recently risen to new record highs, but prices for most finished lumber products started the year well within the range of their 5-year averages. However, as Forest2Market’s SYP composite illustrates, prices have shot up by 140% since early January and there are three primary factors driving the trend:

- Stronger than expected housing starts and unforeseen demand from the remodel sector

- Capacity and supply chain adjustments

- Market speculation driving uncertainty

Strong Demand

As expected, the homebuilding sector has experienced significant turmoil since the onset of the COVID-19 pandemic. Housing starts were down 30% in April to a seasonally adjusted annual rate (SAAR) of 891,000 units—well below the 1Q2020 average of nearly 1.5 million units. But the steep plunge was largely driven by the “lockdown” that kept homebuilding to a minimum during most of the Spring season, especially in states where building was deemed non-essential. Construction rebounded in both May and June, and starts are currently hovering around a rate of 1.2 million units.

Despite this volatility in the housing starts data, demand from the remodel sector never really waned throughout the Spring, which caught the market off guard. Over the last several months, Forest2Market data demonstrates steady, strong demand for decking and “prime” lumber products typically sold through mass retailers rather than construction-grade products that make their way to homebuilders.

The National Association of Homebuilders (NAHB) Remodeling Market Index (RMI) confirms the trend: “In the second quarter, all components and subcomponents of the RMI were well above 50. [Any number over 50 indicates that more remodelers view remodeling market conditions as good than poor.] The Current Conditions Index averaged 77, with large remodeling projects ($50,000 or more) yielding a reading of 70, moderately sized remodeling projects (at least $20,000 but less than $50,000) at 78 and small remodeling projects (under $20,000) with a reading of 83.”

Capacity Adjustments

Modern sawmills are remarkably efficient at meeting lumber demand by turning round logs into square boards while generating very little waste. But they are designed to run at capacity to maximize these efficiencies. An idled mill can take weeks to restart, fine tune its supply chain, and deliver finished product to the market.

During the peak of the pandemic, many sawmills were forced to temporarily curtail or close, thereby removing a sizable chunk of capacity from the market almost overnight. Those manufacturers who were able to keep working had to do their best to match production to a considerable shift in demand. But what was anticipated to be a huge drop in demand was, in reality, a short-lived dip as the remodel sector buoyed overall demand. By the time mid-April rolled around and US lumber output had slowed, Canadian lumber shipments to the US—which make up a significant amount of US supply—were also down by nearly 20%.

Market Speculation

As production capacity has fluctuated, demand patterns have changed, and the lumber manufacturing sector has been chasing a moving target ever since early Spring. For wholesalers and purchasers of finished lumber, who typically buy inventories many weeks in advance, the situation has created a sense of desperation that has resulted in panic buying. They, too, are chasing a moving target as they try to secure a share of limited inventories while staying one step ahead of the competition and maintaining build schedules. When this kind of panic grips a commodities market, it oftentimes spins into a speculative scenario in which prices deviate significantly from intrinsic values.

This combination of events has resulted in a tremendous supply gap in the market. As lumber producers ramp up capacity and attempt to match production to current demand trends, there will continue to be volatility before the supply/demand relationship equalizes and the North American lumber market finds its footing.

Pete Stewart

Pete Stewart