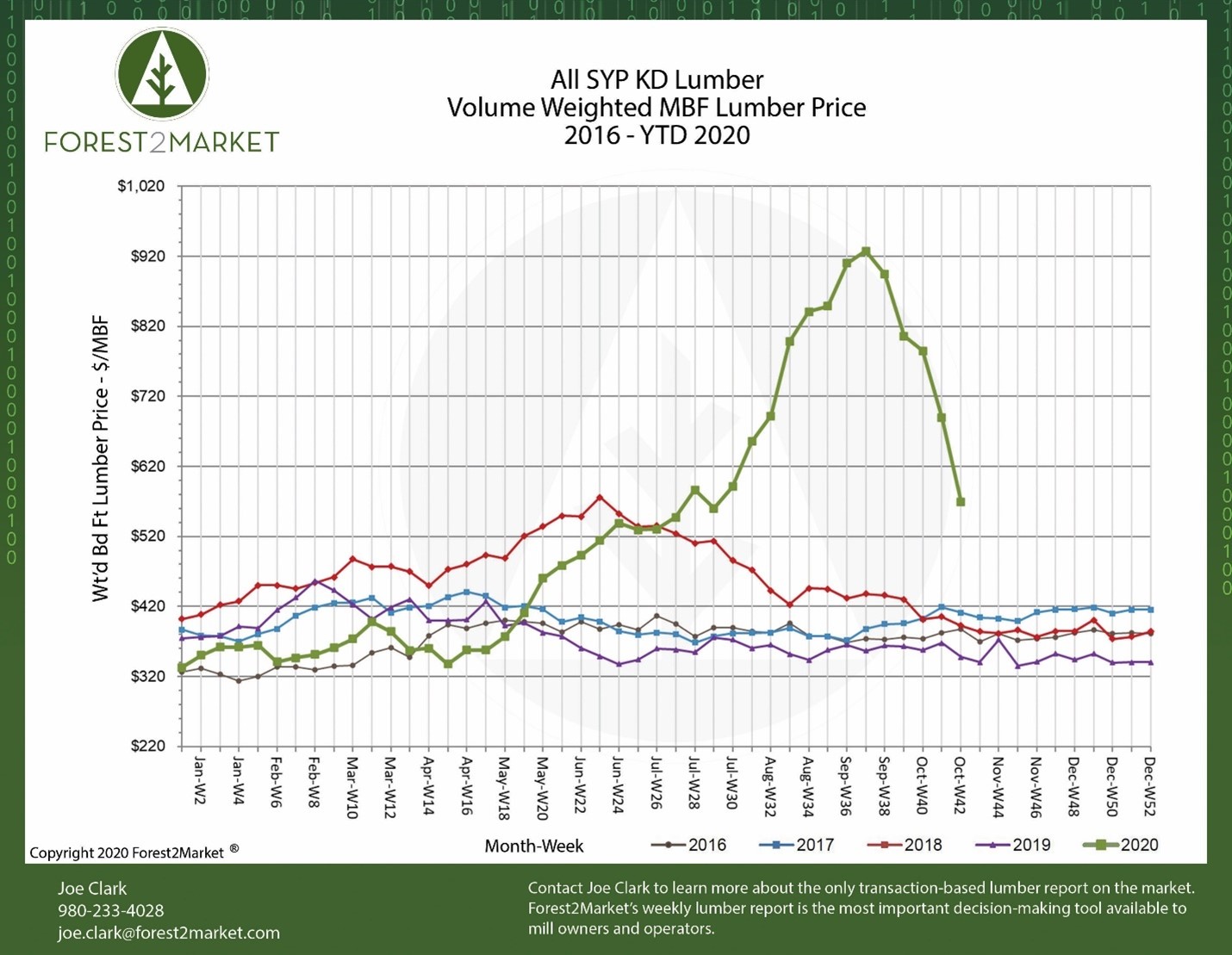

Last week, southern yellow pine (SYP) lumber prices continued a precipitous drop for the fifth week in a row, marking the single largest weekly change—in both dollars and as a percentage—of 2020. Forest2Market’s composite SYP lumber price for the week ending October 16 (week 42) was $569/MBF, a 17.5% decrease (and $121 drop) from the previous week’s price of $690/MBF. Other price trends observed throughout what has become the most chaotic year in recent history include:

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price: $456/MBF

- 3Q2020 Average Price: $761/MBF

- YTD Average Price: $527/MBF

Market View

“This pullback mostly reflects the unsustainable speculative peak that lumber futures experienced. While the series is volatile, the price surge that the futures saw was beyond anything we have seen before,” said Evercore ISI analyst Stephen Kim in a note to clients.

As we wrote earlier this year, the combination of strong (and surprising) lumber demand and pinched supplies from manufacturers resulted in a tremendous gap in the market, and the supply chain is just now beginning to rebalance. While we are more than five months removed from the onset of the lockdowns, the finished lumber sector is now facing a new challenge as production in the PNW has been impacted by devastating wildfires, which have claimed dozens of lives and inflicted significant damage to communities, homes and businesses, and timber resources in the region.

The damage has been so substantial to the accessible timber resource in many parts of the PNW that regional producers will likely be working through salvaged logs for the foreseeable future, which poses a number of potential headaches in itself.

Longtime Oregon solid wood manufacturer Freres Lumber Co. recently wrote an honest and informative appraisal of the situation, which also details the potential challenges they will encounter as a producer of finished plywood, veneer, lumber and chip products in the region:

“We intend to rapidly salvage timber from the Little North Fork area beginning this month, and our intent is to move to higher elevations as they become available next spring. The burnt timber will likely deteriorate quickly, with salvageable value for a period of possibly two years. So, our plan is to aggressively harvest, and in the fourth quarter of this year we plan to harvest as much as we would typically harvest in a year’s time. We will continue to salvage all winter and spring of 2021 as weather permits.

“We are not sure if our facilities or our customers can stomach a full diet of burnt logs. As time moves on we could see a deterioration of the veneer fiber which could reduce the grade out of our veneer products. Additional care must be taken to separate burnt wood fiber from unburnt product, as chip customers cannot process burnt material in their operations.”

As lumber producers across the continent continue to react to market signals and are better able to match production to current demand trends, the log supply issue in the PNW is likely to impact production capacity in the near term. As such, the US South will have to fill any gaps that result from capacity limitations. However, we’re also nearing the end of the traditional building season, which could lead to a dampening in demand and provide a bit of relief to manufacturers during a year marked by record levels of volatility.