Total US housing starts inched up in August, though the pace of single-family building — where the lion’s share of finished lumber is utilized — contracted for the second month in a row; single-family starts decreased 2.8% to a rate of 1.076 million units. However, August residential construction spending increased (+0.5% MoM; +26.8% YoY) including home improvement spending (+0.2% MoM; +8.8% YoY), which is likely a reflection of pinched supply chains and high commodities prices rather than strong demand.

After nine weeks of steady, flat pricing, the lumber market is showing early signs of another price run. Does the housing/remodel sector have enough left in the tank to drive the kind of 4Q lumber price spike we saw in 2020?

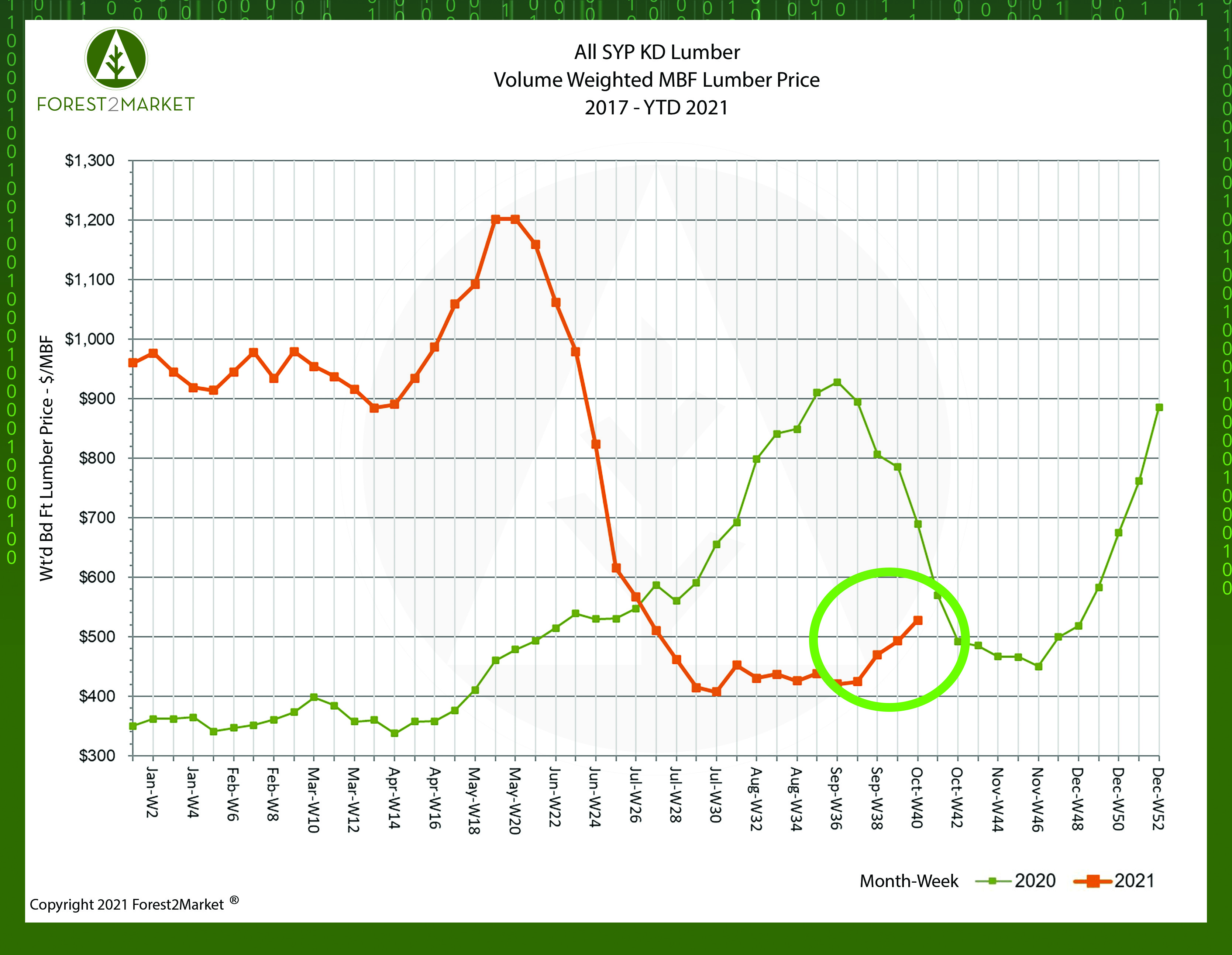

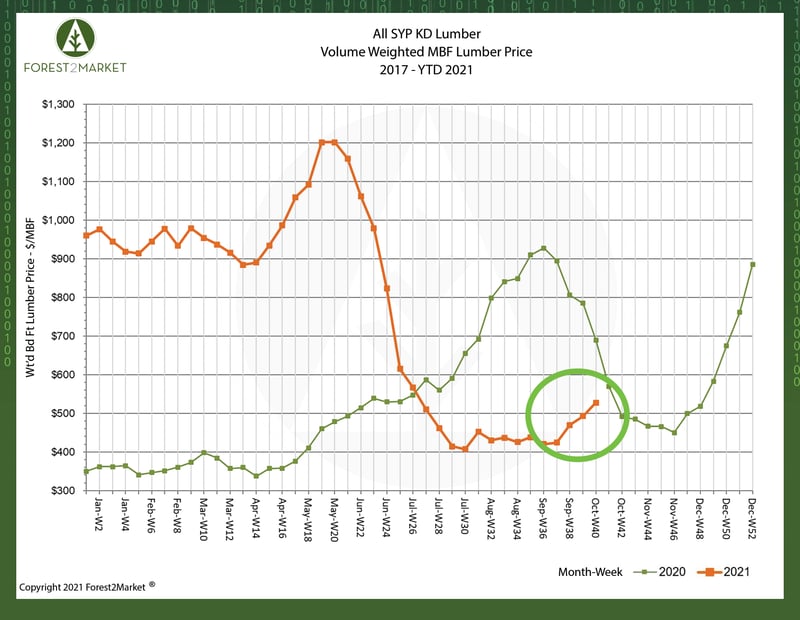

Forest2Market’s SYP lumber price composite for the week ending October 8 was $528/MBF, a 25% increase from just four weeks prior. As illustrated in the chart below, price movement in July and August was minimal, although volatility began to creep into the market in mid-September.

Fortune recently wrote: “While percentage-wise prices are rising fast again, they're still far below the levels reached this spring. But this recent bounce does represent a clear trajectory change for lumber, which spent much of the summer in a free fall after homebuilders and do-it-yourselfers alike balked at exorbitant prices.”

Lumber yard inventories have also largely caught up from the panic buying that peaked in May. Wall Street Journal added, “The gains aren’t likely the start of a wild ride like the one this past spring, analysts and executives say, but the increases show how some of this year’s surge in the price of raw materials is lingering.”

Lumber Moves Toward a New Floor Price

Disruptions not only for finished goods, but also for raw materials and other commodities have stressed global supply chains and driven prices higher. GlobeSt.com’s Erik Sherman notes that “Copper isn’t at the $4.60 to just over $4.70 of mid-March, but still far above the $2.60 in early October 2019. Gypsum building materials are at an all time high, at least since 1994.”

Sherman added, “In other words, while developers and builders likely won’t get walloped with the stratospheric pricing of earlier this year, getting buildings finished is going to cost more than it used to.”

The combination of factors that developed in July — flat demand from the home construction sector and increased lumber inventories — has resulted in a lumber market that is better attuned to current needs than it has been over the last year. This has limited substantial price reactions in either direction.

What’s in store for 4Q2021? I don’t think we’ll see a repeat of the reactionary spike in lumber price that developed in 4Q2020. That said, I do believe lumber prices will continue to move higher – albeit with some erratic week-over-week performance – towards a new floor price above the $500/MBF mark over the next several months.

Joe Clark

Joe Clark