8 min read

New Markets for Wood Products Help Preserve Forests for Future Generations

Forest2Market

:

June 6, 2022

There is an ongoing disconnect that tends to resurface in the debate surrounding the use of woody biomass to create the innovative and renewable products that are displacing fossil-based products. This includes bioenergy (electricity generation) and biofuels for transportation, as well as biochemicals that are used in the development of the biobased products that were unimaginable just a few decades ago.

This is a curious battle for detractors of biomass to wage. On the one hand, there is disdain for all forms of fossil energy. Yet, on the other hand, the world’s most reliable and available renewable resources (trees) must also remain “off limits.”

In the case of wood pellets used for bioenergy production, the primary point of contention is typically framed as: “Burning trees is permanently decimating southern forests.” Such is the case in a recent piece by WFAE, which noted that “The European Parliament is taking steps to reverse climate policies that promote the use of wood pellets to replace coal in power plants. That would put the brakes on a controversial industry that's booming in the Southeast.”

This would be a disappointing step backwards, and a mistake that would impact millions across the UK and EU—especially in light of the tense geopolitical standoff that will result in pinched oil and gas flows from Russia going forward. Ursula Von der Leyen, head of the EU's executive branch, recently stated that a decision to embargo most Russian oil imports will "effectively cut around 90% of oil imports from Russia to the EU by the end of the year."

It seems like renewable forest resources should be a natural option for the EU as an available and proven feedstock, which would largely act as a “bridge” fuel until more efficient and less costly forms of renewable energy avail themselves.

Forest2Market has presented mountains of data and unique forestry insights that overwhelmingly prove the wood pellet industry is not a threat to southern forests. It is also disappointing that the logical conclusion of the anti-biomass argument takes aim at a timberland ownership dynamic in the US South that makes it such a productive forested region. Millions of local, family-owned forests provide income, recreation and healthy habitats for plants and wildlife—a respite from the ever-expanding urban landscapes cropping up throughout the country. This private timberland, often held in trusts, assures that forests remain both strong and vital for future generations.

Additionally, this ownership structure is responsible for the region’s incredibly productive forests that have flourished over the last several decades. Many other forested regions—where a majority of the timberland is owned by government entities (such as the Pacific Northwest)—are needlessly hamstrung by regulatory burdens, are underutilized and in perpetual states of ill health, and are therefore increasingly prone to large-scale destruction via wildfire and pest invasion. Conversely, the South’s market-based timberland ownership structure, in combination with stable and sustainable demand, is a global model of successful forest management and utilization.

Markets Create Blended Solutions

How do we know that a market-based system enables economic and environmental interests to work together? Due to concerns about the initial growth of the wood pellet industry in the US South, Forest2Market was commissioned to examine the history and sustainability of regional forest assets in 2017. For the study, we conducted a statistical analysis for a 70-year period of the forest acreage, demand and inventory, and we uncovered some statistically significant correlations.

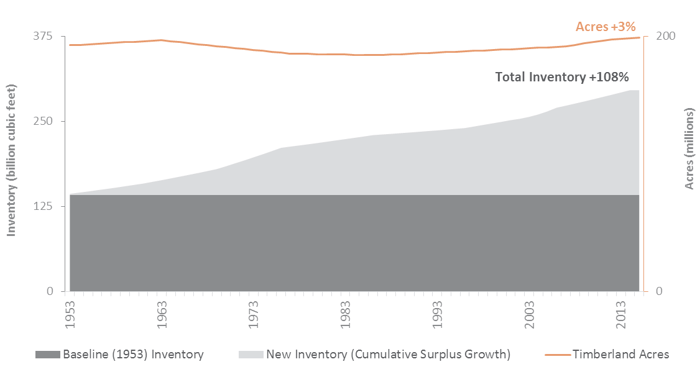

Since the middle of the twentieth century, the amount of timberland in the US South has remained stable, increasing by about 3% between 1953 and 2015. During this period, economic growth and increased construction spurred consumer demand for forest products, which led to a significant increase in timber harvests (removals) by almost 60%. Yet, over this same period, the amount of wood fiber inventory stored in southern forests more than doubled on essentially the same land base.

Forest2Market’s in-depth analysis of historical data over the past six decades documents the link between increased demand for forest products and increased forest inventory. Further, it explains that the dramatic increase in forest inventory was made possible by even more remarkable increases in forest productivity, especially on privately-owned timberlands.

- Rising demand for forest products drives increased removals from timberlands. As the US population and GDP grew in the last half of the twentieth century, so did its demand for wood-based products. Annual timber removals nearly doubled by 1996 and were 57% higher in 2015 than they were in 1953.

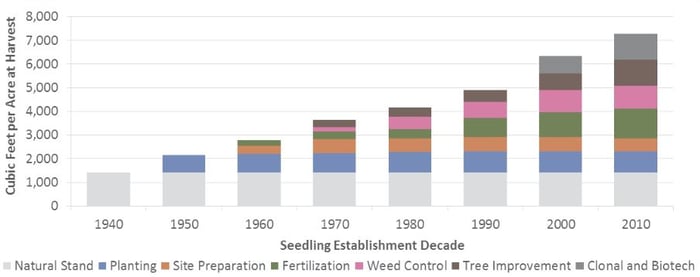

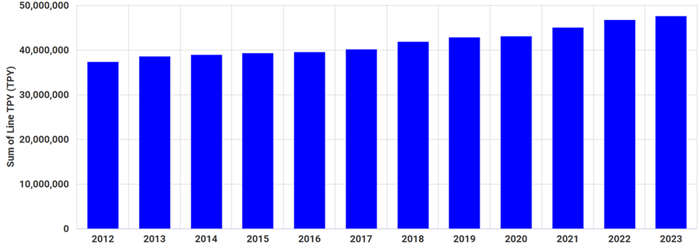

- The forest products industry and landowners responded by increasing the productivity of their forests. To ensure their mills would have a stable, high-quality source of supply, forest products companies invested heavily in research to promote forest productivity by improving management practices. These practices drove the development of high-yield plantations that resulted in a 3.5x increase in wood inventory per acre, which increased availability of wood fiber on timber plantations and thereby reduced harvest pressure on natural stands of timber. The following chart shows the significant impact on standing inventory achieved by advanced silviculture practices in response to market demand.

- Increased demand has not depleted forests. The number of timberland acres has remained stable, increasing by 3%. At the same time, total inventory has doubled (+108% from 142 to 296 billion cubic feet) because growth has outpaced removals.

- Statistical analyses show that increased demand is associated with better growth and larger inventories. Regression models show statistically significant correlation (65-90 percent) between demand and inventory.

The statistical correlation is that increased demand results in increased inventory, not the opposite. How does this happen?

This is because timber and the land timber occupy are economic assets. As in any market, when there is strong demand, owners actively manage their assets to maximize economic return. In this case, timberland owners manage their forests to maximize tree growth – especially the growth of the highest value product from the forest (sawtimber) – which increases their return on investment. Forest products and bioenergy manufacturers then use the raw materials that they purchase to the fullest extent possible, including the utilization of low-value trees and residual products for energy production where markets exist.

The growth of the forest products industry, including the wood pellet sector, continues to create new demand for biomass, which has resulted in an increase, rather than a reduction, in forest inventory. In other words, healthy demand is driving reforestation, not deforestation across the US South.

Forest Management 101

While much of the feedstock material used to produce biomass and wood pellets consists of wood chip residues generated from other wood products manufacturing processes, it is important to clarify that many pellet producers also use low-value pulpwood in the manufacturing process. This is a major point of contention among biomass detractors, though they fail to connect the dots between supply and demand of low-value wood raw materials.

How are harvested trees routed through the forest supply chain?

The sizes of the trees removed from timberland are quite different, serve a range of needs, and therefore vary in value. In general, southern pine logs fall into one of the following categories:

- Trees that are 5”-7” diameter at breast height (DBH) are considered “pulpwood” once they are harvested, and they are most frequently converted to wood chips.

- Trees that are 8”-11” DBH are considered “chip-n-saw” (CNS), which may be used as small logs by sawmills or converted to chips like pulpwood.

- Trees that are 12”+ DBH are considered “sawtimber,” which will be used exclusively by sawmills and other solid wood manufacturers.

Timberland owners who manage their land for timber production have historically managed for large diameter, high-value sawtimber logs. Centuries of demand for solid wood products used for structural purposes has driven this paradigm, as larger logs result in better yield and quality in solid wood manufacturing. Landowners are therefore incentivized to grow larger logs through high price offerings from these manufacturers. As such, timberland management practices have evolved over time to maximize real returns on large logs, with landowners implementing silvicultural prescriptions to yield larger, high-value logs at a faster rate.

One such management practice known as “thinning” involves removing low-value pulpwood, which is generally confined to small, misshapen, deformed and off-species trees within a stand of timber. This process reduces competition for soil nutrients and opens the forest canopy to allow more sunlight into the forest, which induces higher growth rates for the remaining high-value trees. These trees continue to grow until reaching larger diameter and quality specifications to be considered for solid wood product manufacturing.

The Economics of Wood Consumption

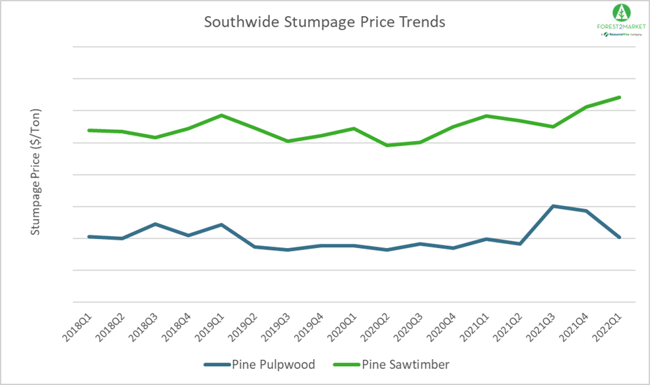

Basic economics and industry best practices ensure that harvested trees are used to maximize their value. Consider the price differential between sawtimber and pulpwood: In 1Q2022, the Southwide volume weighted average price (stumpage) for pine sawtimber was roughly 214% higher than the price of pine pulpwood.

Timberland owners will not harvest all of their timber as small trees at a significantly lower price when they can harvest mature trees for a much higher return. In addition to the higher value for larger logs, the increased growth of the trees in the intervening years also results in several additional tons of sawtimber that can be sold at the higher price. Economically, it makes no sense to do otherwise.

Therefore, there are three important points to understand about the economics of pulpwood supply:

- Pulpwood is the lowest-value, smallest-diameter product that can be removed from a stand of timber.

- While the incremental cash flows from pulpwood sales are not the primary motive for thinning, demand for pulpwood results in incremental cash flows for timberland owners. The relative stumpage price differential between pulpwood and sawtimber upholds the justification for managing timberland to yield more sawtimber.

- This also ensures pulpwood harvests remain a result of land management prescriptions as opposed to the incentive to manage for pulpwood production.

Existing Markets for Low-Value Wood

The growth of e-commerce has increased demand for packaging and shipping boxes (containerboard), which are produced from both pulpwood and residual chips – a manufacturing byproduct. This demand trend – exacerbated by the COVID-19 pandemic – saved the corrugated and containerboard segments from a downturn in 2020.

US Containerboard Capacity (Actual and Announced)

Source: FisherSolve

While demand for containerboard continues to grow, demand for printing and writing papers is shrinking; it declined 20% in 2020 due to impacts associated with the COVID-19 pandemic, and is projected to decline by 6% annually going forward.

The pulp and paper industry drives steady demand for pulpwood throughout the South, but for landowners who have made the long-term investments necessary to significantly improve forest productivity and increase inventory on a stable land base, segments of the larger “biobased” industry have opened up new markets for their low-value, small-diameter timber. In a dynamic economy, these outlets are imperative for ensuring the long-term viability of managed timberland. The result is an environmental/industrial relationship that produces innovative, valuable products while also using low-value materials for beneficial purposes where markets exist.

New Opportunities for the Forest Value Chain

Under growing Environmental, Social, and Corporate Governance (ESG) pressures, global policymakers are aiming to transform the world’s economy from a linear one to a circular one. This transition is expected to be accomplished by expanding energy portfolios, converting more plastic waste into secondary raw materials, and making more consumer items reusable and recyclable.

And sustainability issues are accelerating: 71% of global fund managers representing $13 trillion in assets believe COVID-19 will lead to an increase in actions designed to tackle climate change and bio-diversity losses – and the forest value chain has a tremendous role to play in the transition to a greener economy. Recent biobased projects utilizing wood raw materials that Forest2Market has had the privilege of working on include:

- USA BioEnergy recently announced the development of a $1.7B advanced biorefinery that will convert 1M green tons of wood waste into 34M gallons annually of clean burning transportation fuel including Sustainable Aviation Fuel, Renewable Diesel and Renewable Naphtha. Forest2Market spent months researching and reviewing data to provide both availability and a cost analysis of the materials for the advanced biorefinery under development in Bon Wier, Newton County, Texas.

- Origin Materials recently announced that Geismar, Louisiana will be the location of its first world-scale manufacturing facility that will produce chloromethylfurfural (CMF) and hydrothermal carbon (HTC) using wood residues. The chosen site will sit along the Mississippi River with easy access to barge and rail and plentiful local wood residue feedstock. The local industrial cluster can provide access to hydrogen, ethylene, water treatment, etc. Origin Materials worked closely with consulting teams at both Fisher International and Forest2Market in the site selection process for the project.

An increase in forest stocking levels is the ultimate environmental benefit, which naturally occurs when landowners manage their timber resources for economic purposes. It is this symbiotic relationship that, most importantly, incents timberland owners to keep forestlands forested and invest in advanced timber management practices, which provides both economic benefits to the timberland owner and environmental benefits to all of us.

When forestland ownership becomes uneconomical, the risk for converting the land to other uses increases. With such conversion, the forest is lost forever. Keeping the economics of private forest ownership strong, including the utilization of low-value forest materials, is a key component in preserving the proven relationship between environmental and economic interests of the forest.