As I wrote just a month ago—in the initial days of the coronavirus pandemic once it gripped the US— “Even if the virus ultimately doesn’t create a full-scale pandemic, it’s easy to imagine how force majeure disruptions to supply chains (e.g., two-thirds of China’s economy was shuttered for an extra week following the Lunar New Year, and residential areas of Beijing have been locked down) might spawn a banking crisis—perhaps first in the export- and China-dependent Eurozone—that ultimately cascades around the world.”

Wow. Did I miss the mark.

It's difficult to comprehend, with the benefit of hindsight, that such a dismal forecast would be on the moderate side of what has ultimately unfolded across the globe. As Pete Stewart recently wrote, we are truly in unprecedented times with no historical correlations to use as reference points.

The situation has hit the new-construction market hard and swift, which has impacted lumber demand, prices and capacity.

Woodworking Network noted recently that “Canadian lumber giants Interfor, West Fraser, and Western Forest have announced major output curtailments due the outbreak of the coronavirus (COVID-19). Interfor has announced it's cutting its lumber production in British Columbia, the Pacific Northwest, and the southern U.S. by 35 million board feet per week, for two weeks. That's about 60 percent of its capacity.”

Southern Yellow Pine:

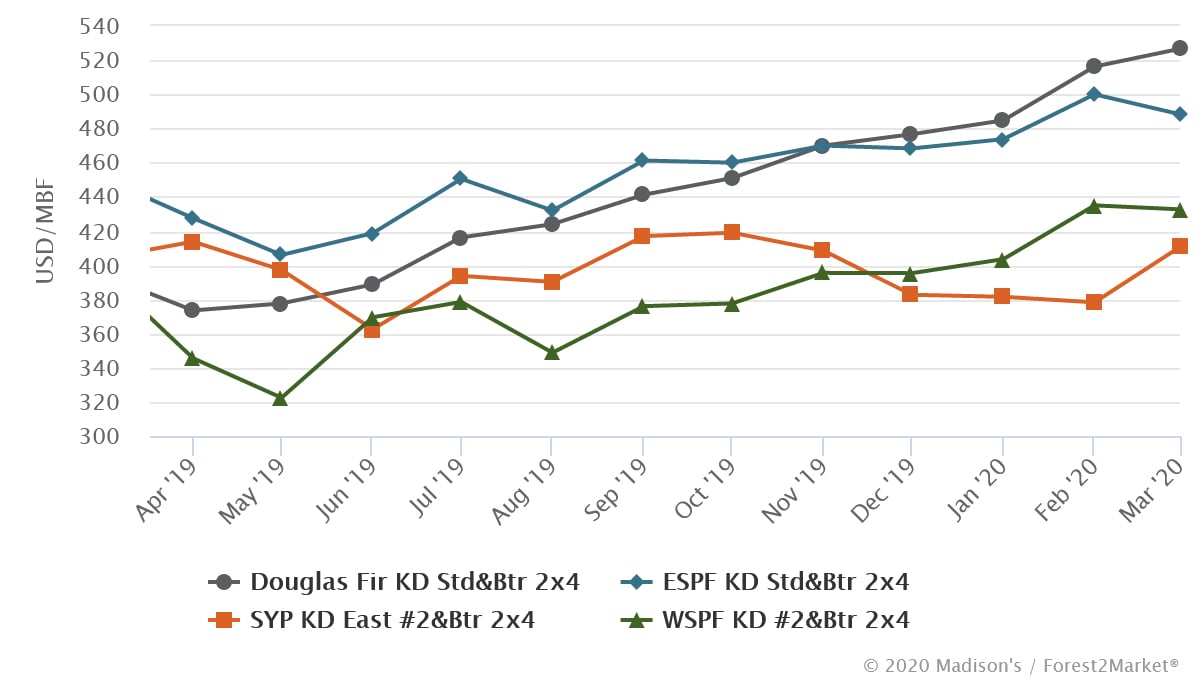

Building on four weeks of increases, southern yellow pine (SYP) lumber prices surged in early March to their highest level since April 2019. However, no doubt driven by the pervasive sense of panic that has gripped the world surrounding the COVID-19 contagion, SYP lumber prices reversed course in late-March and dropped 3.5% (week-over-week) for the week ending March 20.

While we are in a highly fluid situation, prices will likely begin trending down in the coming weeks based on slack demand as homebuilding has all but halted in most markets. Per CNBC: “The SPDR S&P Homebuilders ETF (XHB) has seen an outsized decline relative to the S&P 500 year to date as investor worries about a possible economic slowdown tied to the global spread of the coronavirus multiply, with the group falling nearly 24.5% versus the S&P’s more than 20.5% loss.”

It's difficult to tell where prices will settle as the market rebalances to account for the “new normal,” and lumber manufacturers begin to align production with the dramatic shift in market conditions. As Ian Fillinger, Interfor’s president and CEO noted: "We are very focused on ensuring the health and safety of our employees as well as adapting to the evolving market conditions. In addition, Interfor will remain disciplined in its approach to capital deployment as it focuses on retaining a strong capital structure."

While North American lumber prices will moderate in the coming weeks, the scheduled decreases in production will likely limit the downside price pressure that will be driven by slack demand as manufacturers draw down their inventories. The US/Canada border remains open to trade and commerce at this time; however, pricing and inventory levels will likely change should trade restrictions take effect.

This ability to quickly react to market signals and match production to the market as needed is what makes North American lumber manufacturers so competitive in a global market.