When the Madison Paper mill in Maine closed this month, it marked the loss of the last major softwood pulpwood market in New England. Since early 2014, mill closures in Bucksport and East Millinocket, a capacity reduction at the mill in Jay, and the recent Madison closure have cut roughly 2.1 million tons of softwood pulpwood demand in the state. The closures have also have left loggers and landowners struggling to move softwood pulpwood to other regional mills that use some volume of softwood as part of their species mix.

To put this volume in perspective, 2.1 million tons equates to 192 truckloads of wood running 365 days per year—and that only represents the volume lost in the softwood markets. Maine has also lost a hardwood pulp mill in Old Town, two biomass electricity plants, as well as biomass markets at a number of the closed pulp mills.

While New England has vast forests of northern hardwoods, the region also has a significant softwood inventory as well. Spruce-fir, hemlock and white pine stands cover much of the territory, and these species face a challenging future as the regional markets for low-grade wood become increasingly limited. In 2014, the last year for which complete data exists, Maine timberlands produced 2.7 million tons of softwood pulpwood. This volume of wood simply couldn’t find a home on today’s market.

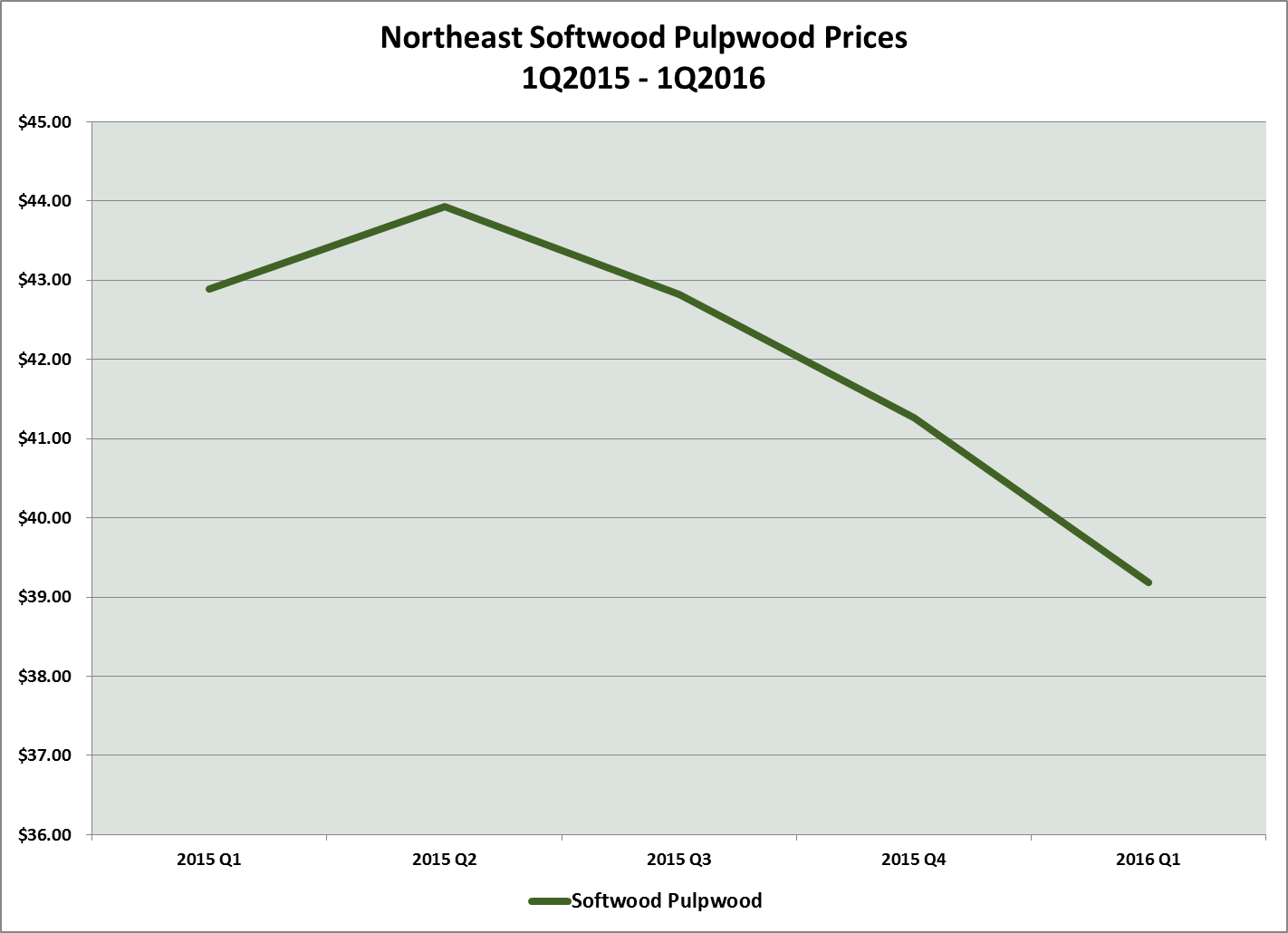

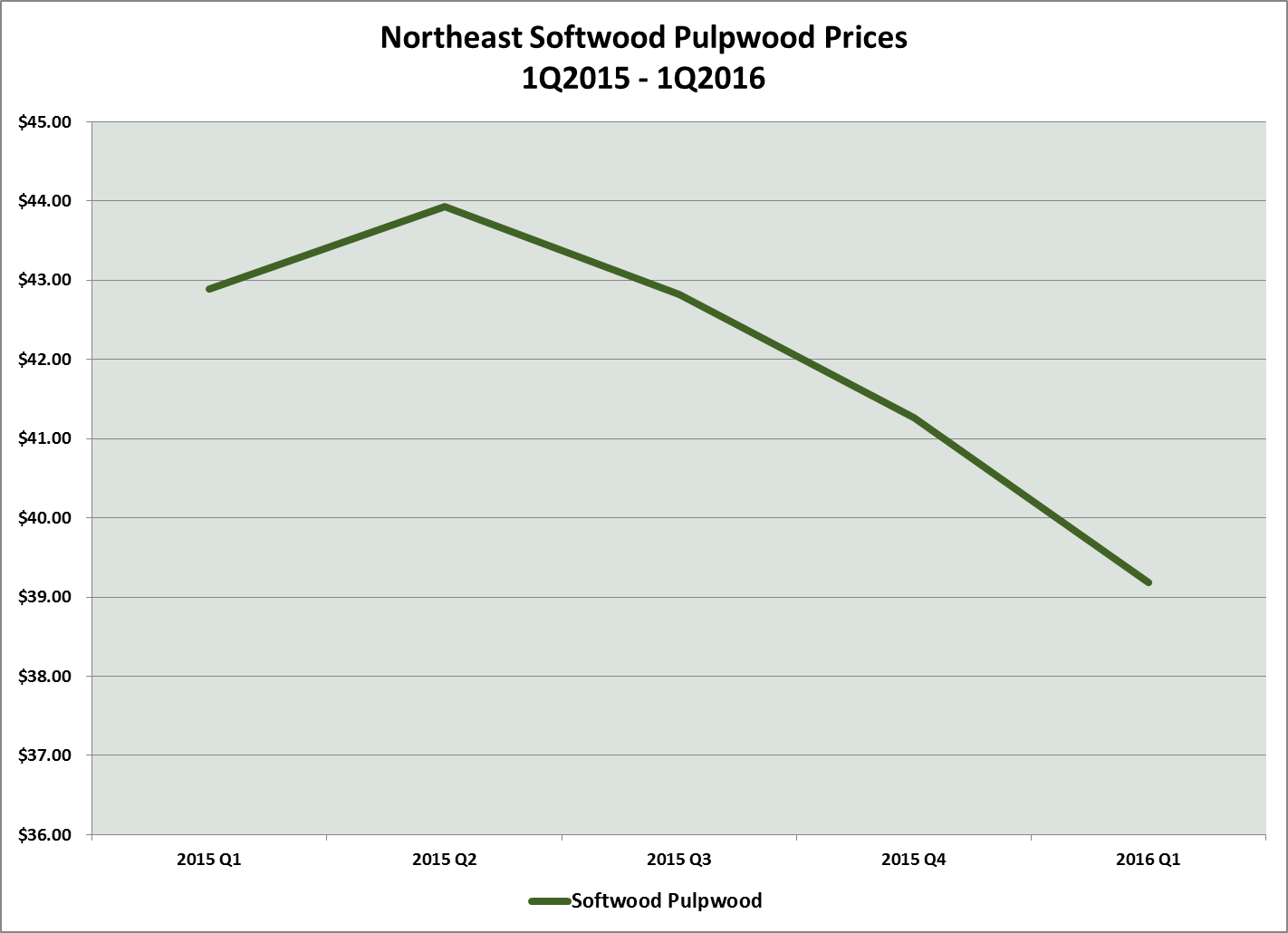

Of course, basic economics dictates that a reduction in demand of this magnitude will cause a price drop, and it has; Forest2Market’s data shows a price drop of almost 9% over the past year. Given the steep drop in demand, a fair question to ask then is, “Why hasn’t it dropped even lower?”

Again, the answer has to do with basic economics. While markets have declined, the cost to harvest and transport a ton of softwood pulpwood hasn’t changed significantly. Diesel prices have dropped about $0.50 in the past year, but the cost of operating harvesting equipment, trucks, and professional logging crews hasn’t dropped with fuel costs. This means that it costs about the same to get a stick of softwood from the stump to the landing, and then on to the mill.

Due to the decrease in demand, this price reduction we’re witnessing in the market is hitting landowners in the form of lower stumpage prices, or the prices they are paid for the harvested trees on their land. Some landowners—particularly those in Maine’s Penobscot River Valley, where so many markets have closed—have seen dramatic decreases in softwood stumpage prices. And that’s if they can find a market at all.

While the loss of softwood markets has affected the entire regional supply chain, it has also created opportunities for new market entrants. A number of existing paper mills are experimenting to see if they can increase their use of (now abundant) softwood while maintaining yield and quality. Entrepreneurs and developers are also looking at this resource for use in wood pellet and biofuels manufacturing, chip exports and a number of other wood raw materials markets as they are seeking to find new economic uses for low-grade softwood.