2 min read

Southern Timber Prices Continue to Trend Lower in 3Q2022

Forest2Market

:

November 28, 2022

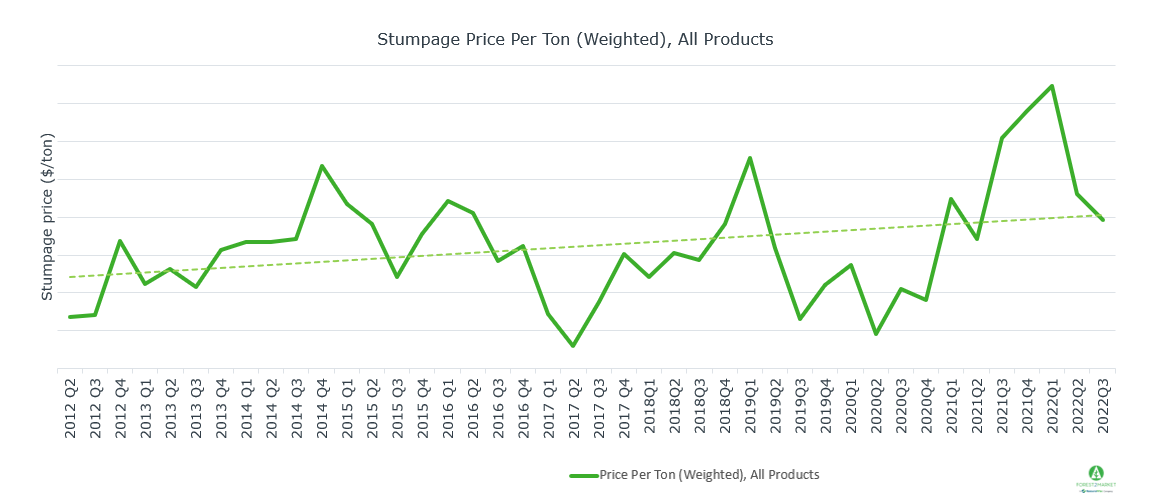

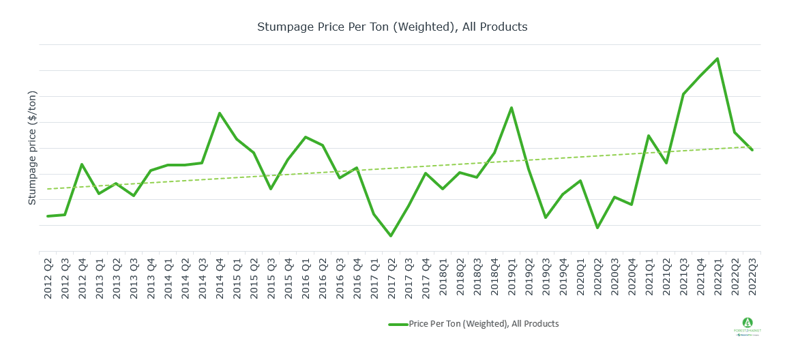

Following a 15-year peak in 1Q2022 and a sharp decline in prices in 2Q2022, the weighted average price for southern timber continued trending lower, with pine trending higher and hardwood prices, especially hardwood pulpwood, trending lower. Stumpage prices for 3Q were down compared to this time last year as well as last quarter, with a -10% decline year-over-year (YoY) and a -4% decline quarter-over-quarter (QoQ). Southern timber prices have demonstrated significant volatility since 2017; however, prices for all products have trended upwards over the last ten years.

Pulpwood

Pulpwood

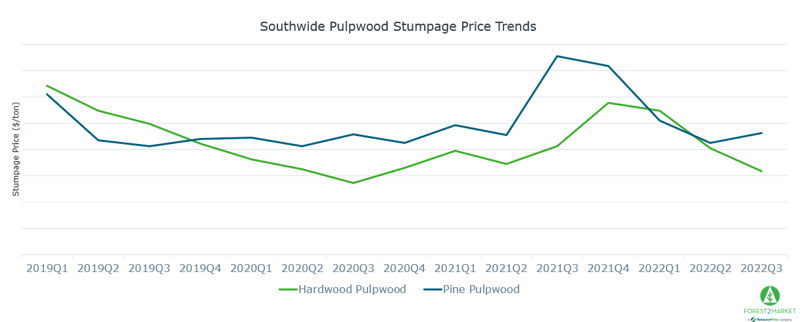

Both hardwood (HPW) and pine (PPW) pulpwood pricing collapsed in 1Q2022 and 2Q2022 – however, the trend continued in 3Q for HPW, but not PPW. Southwide prices for PPW increased +9% QoQ, experiencing a decrease in two of the three regions for this product. Prices in the East-South were down -8% and prices in the West-South dropped -12%, but prices in the Mid-South jumped +4%.

Demonstrating even more volatility, Southwide prices for HPW plummeted -22% QoQ, also dropping in two of the three regions. Prices in the East-South were down -32% percent, along with prices in the Mid-South decreasing -13%. Prices in the West-South increased +25%. In the chart below, notice the tight 2Q price parity between PPW and HPW has shifted away in Q3, creating a larger price gap between the two.

Sawtimber & Chip-n-Saw

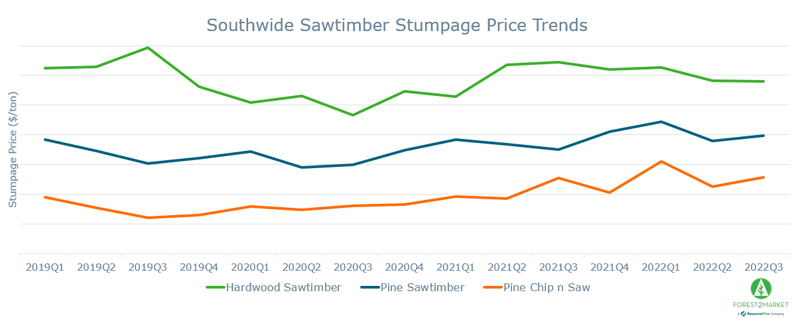

Compared to the previous quarter, prices for pine logs in 3Q2022 creeped up on a Southwide basis. Pine chip-n-saw (CNS) prices were up +7% QoQ, experiencing increases in two of three regions. CNS prices edged up by +7% in the East-South, and by +5% in the Mid-South. Prices in the West-South bucked the trend, however, dropping by -20% QoQ.

Southwide pine sawtimber (PST) prices rose by +3% QoQ as prices for this product were up across all three regions. Prices in the East-South nudged up +1%, prices in the Mid-South +3% and prices in the West-South +2%.

After experiencing a significant decline in 2Q, Southwide hardwood sawtimber (HST) prices in 3Q stayed relatively stable with only a -0.2% decrease QoQ as prices rose in two of the three regions. Prices in the East-South were up +4% and prices in the West-South +2%, and prices in the Mid-South dropped -3%.

Outlook

Total precipitation across the South was nearly 5” below the 5-year average in 3Q, which provided some relief for harvesting operations working on tracts that were purchased during the end of 2021 – a particularly wet period. However, precipitation levels have increased (along with some significant flooding) in a few areas over the last several weeks, especially in the West-South region.

Finished lumber prices have dropped from the $1,000/MBF mark where they remained for most of 1Q2022, primarily due to strong demand, trucking and transportation bottlenecks, and pinched trade flows from Canada. Per Forest2Market’s southern yellow pine (SYP) lumber price composite, prices are now down nearly 50% from the high achieved in March as inflationary pressures, rising interest rates and economic concerns are causing trepidation in the new-construction sector.

Stumpage Prices from SilvaStat360

While the southern timber market has been oversupplied for a decade, stumpage markets are growing increasingly volatile on a QoQ basis. Your timberland may be one of the most valuable investments you own and if your goal is to protect this important asset, Forest2Market’s SilvaStat360 can help you.