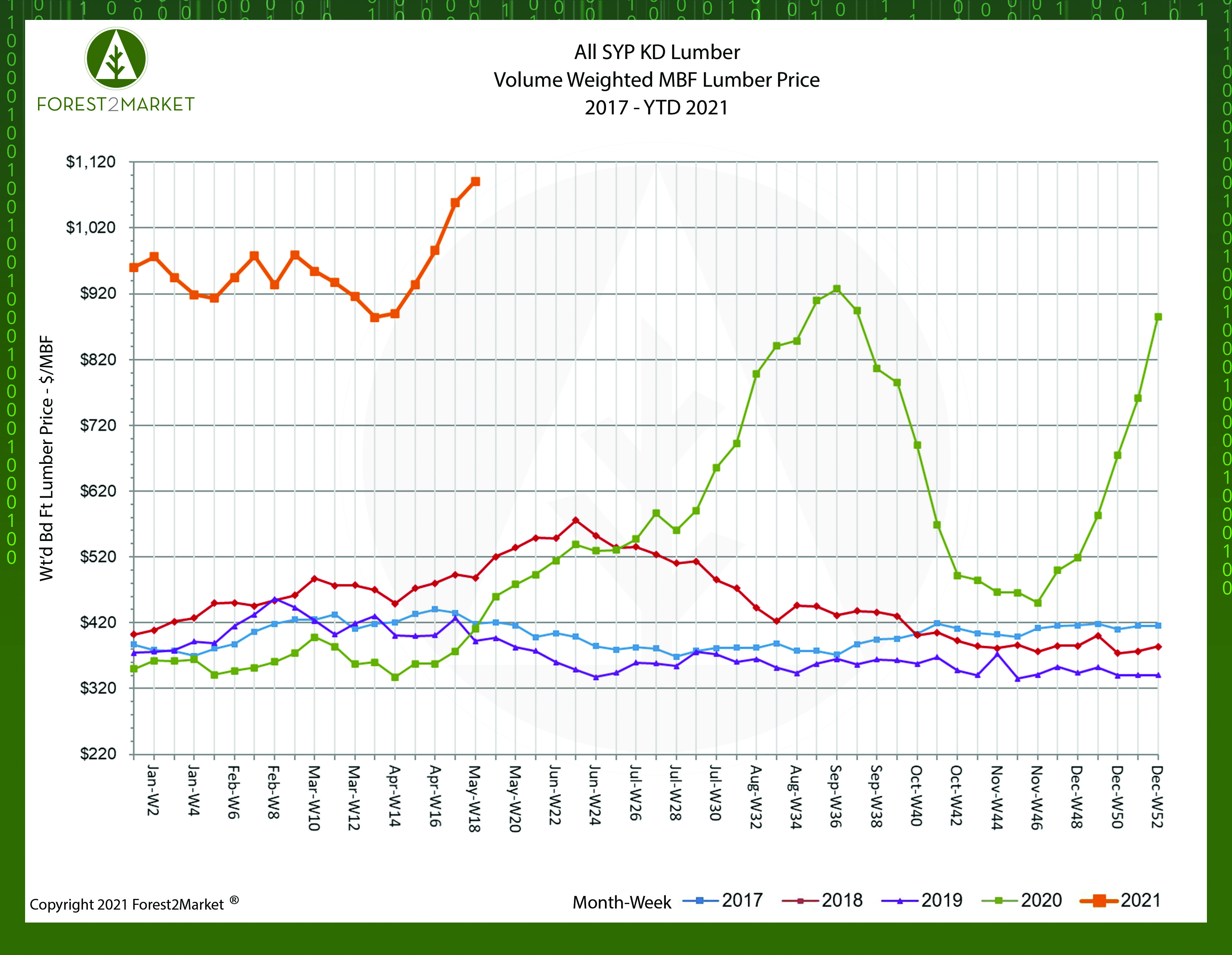

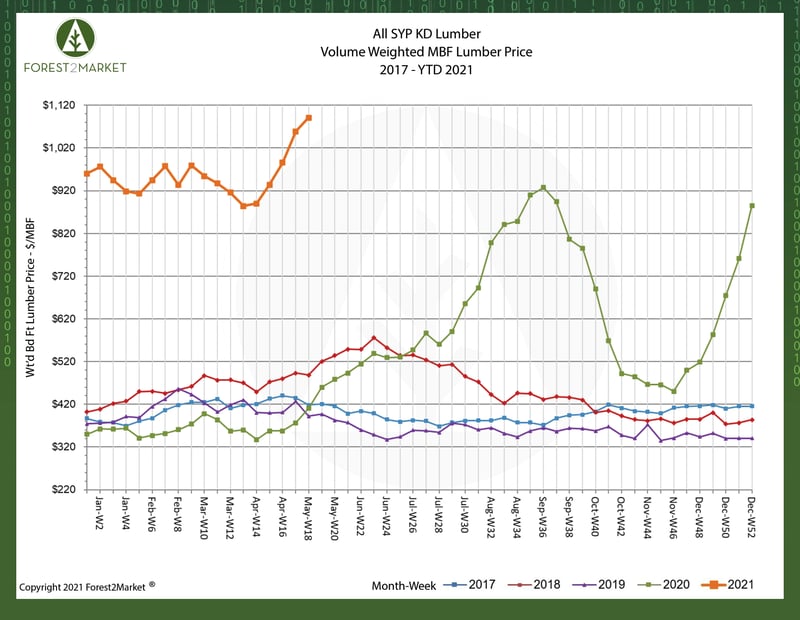

Prices for North American softwood lumber continue to shatter previous records achieved just a few weeks ago. As we move further into 2Q2021 and peak building season, demand for finished lumber remains insatiable, which is reflected in Forest2Market’s SYP lumber data from early May.

Forest2Market’s composite SYP lumber price for the week ending May 7 (week 18) was $1,091/MBF, a 3.0% increase from the previous week’s price of $1,059/MBF and a 166% increase over the same week last year. A look back at 2020 price trends illustrates the incredible surge that developed in 2Q before peaking in 3Q, and the trend that has formed thus far in 2021 is equally astonishing.

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price: $456/MBF

- 3Q2020 Average Price: $761/MBF

- 4Q2020 Average Price: $580/MBF

- YTD2021 Average Price: $956/MBF

While the 2020 run-up in lumber price was demand driven, the pandemic created such an imbalance in the market that evolving demand patterns continue to keep us all guessing. Despite significant decreases in January and February, fresh data from the US Census Bureau shows that privately-owned housing starts soared in March to their highest level since 2006. March starts were at a seasonally adjusted annual rate of 1.74 million units (MU), which is 19.4 percent above the revised February rate of 1.46 MU and 37.0 percent above the March 2020 rate of 1.27 MU.

Supply constraints are poised to become more acute in the near term, which will apply upward price pressure on the lumber sector. How high will prices go? How can SYP lumber manufacturers capitalize on current market conditions?

Forest2Market produces the only transaction-based lumber price reports available to the southern sawmilling industry, which arms subscribers with the most accurate and precise lumber market performance indicators.

- The Weekly Lumber Price Report provides access to volume weighted average prices by grade and length (including MSR & mixed loads) for dimensioned lumber, decking and timbers, as well as price and volume changes from the previous week and market price variation during the week. Subscribers use this data to base purchase price and negotiations, make better-informed production and sales resource allocation decisions, and improve net sales realization and profits.

- The Quarterly Lumber Price Benchmark provides subscribers with a complete and accurate picture of their individual operations and how they compare to the broader market. Subscribers are able to fine tune their purchase and sales strategies and make decisions confidently. The benchmark provides all the data needed to identify areas where revenue can be maximized and costs can be reduced. Participants can perform product mix comparisons to identify more profitable/less costly substitutions, then choose the most profitable grades and dimensions to produce given log quality, grade and dimension yields.