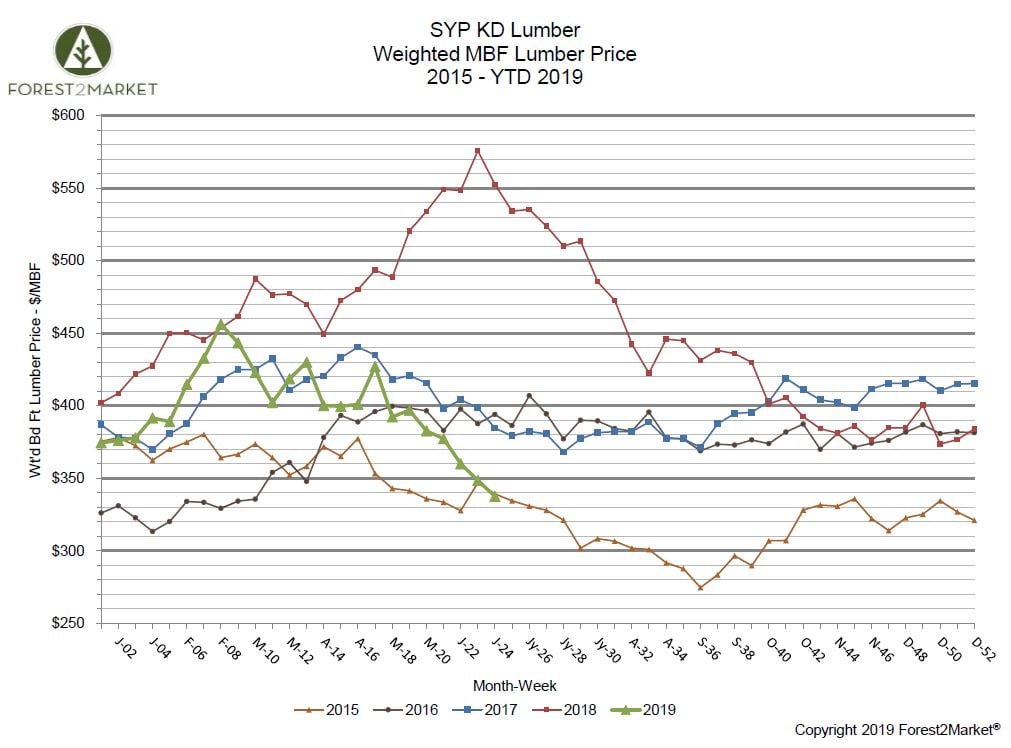

As we approach the midway point of the year—and the peak of the 2019 building season—southern yellow pine (SYP) lumber prices are at a significantly different spot than they were this time last year. To put the current slump in perspective, SYP lumber prices recently plunged to their lowest level in more than three years.

Southern yellow pine lumber prices dropped for the fifth straight week in a row in mid-June, sinking to their lowest point since March 2016. Forest2Market’s composite SYP lumber price for the week ending June 14 (week 24) was $338/MBF, a 3.2% decrease from the previous week’s price of $349/MBF, but a 39% decrease from the same week in 2018.

- 1Q2019 Average Price: $410/MBF

- 2Q2019 Average Price: $384/MBF

- YTD Average Price: $398/MBF

As the weather dries up and log costs continue to recede throughout the South, the North American lumber market continues to be perplexing. Both orders and shipment of SYP were strong in weeks 23 and 24, suggesting that there is adequate demand in the market despite the unceasing price drop. At the same time, many producers in the Pacific Northwest (PNW) and British Columbia (BC) are either curtailing their operations or closing them altogether, which should theoretically divert at least a portion of the existing demand to southern operations. However, after a dismal 1H2019, the situation is beginning to change in the West.

As Keta Kosman noted via Madison’s Lumber Reporter during week 24, western spruce pine fir (WSPF) producers in both the US and Canada finally saw the significant bump they have been hoping for.

- In the US PNW: “Following a major curtailment announcement Monday, the WSPF market ‘exploded’ as the week wore on. While suppliers did spend some time early in the week clearing out older inventory, asking prices were up significantly and sawmill order files were pushing into July as Friday rolled around. After briefly—and brutally—dipping below US$300 mfbm, the price of standard 2x4s shot up $78 to US$376 mfbm, while 2x6 vaulted $52 to $338. The sense was that ‘this is only the beginning’ of a rally that may eventually allow curtailed and temporarily shut-down sawmills to get production back to normal. And to bring back embattled employees.”

- In BC: “Sales of WSPF in Canada appeared to be finally ‘on the upswing’ this week, with inquiry bursting out of the gate from Tuesday-on. Prices surged up and sawmill order files were extended into the week of July 1st, with ‘only the odd item’ available sooner. Myriad curtailments and shut downs had the desired effect of reducing supply, but at the unfortunate cost of hundreds of jobs lost or hanging in the balance. Construction markets all over North America continued to wake up slowly and low field inventories prodded buyers to get deals done.”

Capacity may be throttling back and shuffling from region to region, but the fact remains that housing starts have failed to impress thus far in 2019 and the lumber market is reacting to the slack demand. The tense trade situation with China is also not helping matters. However, there are signs on the horizon that the federal government may attempt to “prime the pump” in an effort to keep things moving.

Writing for Seeking Alpha earlier this month, Andrew Hecht notes that “The Trump administration has not been happy with the Federal Reserve, even though the President nominated Jerome Powell as the Chairman succeeding Janet Yellen. After hiking the Fed Funds rate four times in 2018 to 2.25-2.50%, the President and members of his administration called for the central bank to lower rates by 50 basis points. On June 10, President Trump said that the Fed has been ‘destructive’ when it comes to both economic growth in the US, and the ongoing trade dispute with China. Higher rates support the value of the dollar, which makes US exports less competitive in global markets giving China the upper hands as they devalue their currency, the yuan.”

Hecht continues, “Meanwhile, the trade dispute and signs that the US economy is weakening have softened the hawkish Fed who earlier this year canceled any rate hikes for 2019. The latest statements out of Fed officials have been supportive of a rate cut in 2019. As of last Friday, Eurodollar futures were projecting a 60% probability of two rate cuts totaling 50 basis points by the end of 2019, and some analysts are projecting the Fed will act three times for a total of 75 basis points this year.”

While these adjustments may provide a temporary bump to housing growth, will it create enough sustainable demand for manufacturers in the PNW and BC to ramp up production, and will it be enough to limit the drop in SYP prices through the summer months?