Like other regions in the US, the forest products industry in the Pacific Northwest (PNW) has remained surprisingly robust since the COVID-19 pandemic shutdowns that began in March. Demand for wood products has been strong in 2020; led by skyrocketing demand for tissue products from March through June, demand for lumber from July through October has kept mills humming throughout the region. As we approach the end of a tumultuous year, which has also been marked by devastating wildfires in the PNW, there is guarded optimism going into 2021.

Regional Log & Lumber Demand

Demand for good quality PNW Douglas fir logs really picked up steam in the early summer months, gaining back losses from earlier in the year. Home center R&R sales remained strong throughout the lockdown, and mills that had program contracts with mass retailers continued to meet demand without much disruption. Lumber and panels were offered at a seller’s market as end users clamored for building materials.

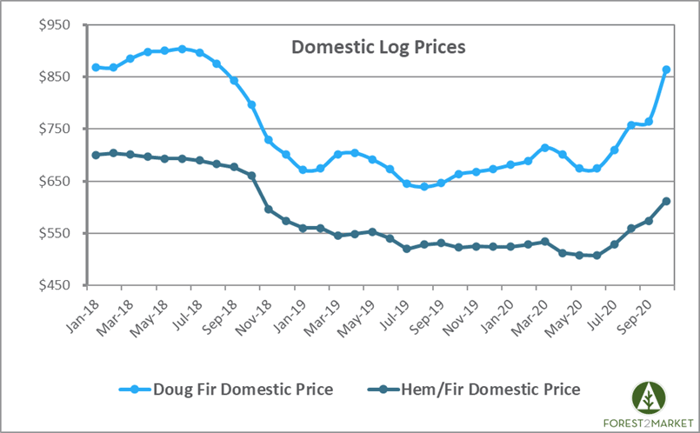

Soaring demand for finished forest products and renewed interest in logs drove prices higher through the summer months and into the fall. Shrinking log decks in combination with tight supplies due to logging restrictions from extreme weather and ravaging wildfires caused domestic log prices to surge; in October, Doug fir prices hit prices not seen in the region since August 2018.

Once the wildfires were under control in September, the shocking extent of damage caused by the fires became apparent. So much timber has been damaged, in fact, that crews will be cutting to salvage fire-killed timber for many months - even years. In particular, the Cascades region of Western Oregon that stretches over a vast area from California to the Columbia River suffered great loss of resources. For example, in Lane County, Oregon, 2018 annual harvest totaled 559 MMBF; fire losses on the county’s private forests alone may amount to nearly one-year’s total harvest.

Initially, many regional mills were reluctant to buy too many burned logs due to worries about degradation in wood quality and a high potential for chip loss. On many highways into the fire area, most all truckloads of logs traveling the road are burned. The damage is so widespread that most mills have resigned themselves to the reality that they must utilize burned logs by segmenting deliveries and carefully processing them to assure quality standards are maintained.

The fires also caused a significant loss of logging machinery in the region; upwards of 100 pieces of specialized, high-value equipment have been destroyed. This has added even more strain on regional logging capacity, as labor remains tight due to competition from construction and other heavy industry. Trucks and truck drivers have been in very short supply to transport harvested logs to the mills. This shortage of logging capacity will continue even as additional crews and machinery from nearby areas have been brought in to help keep the wood flowing.

Prices for finished lumber plummeted during the early part of the pandemic but they reached record highs in late September. As Pete Stewart wrote in August, stronger than expected housing starts and unforeseen demand from the remodel sector caught the lumber market off guard during the peak of the national lockdowns.

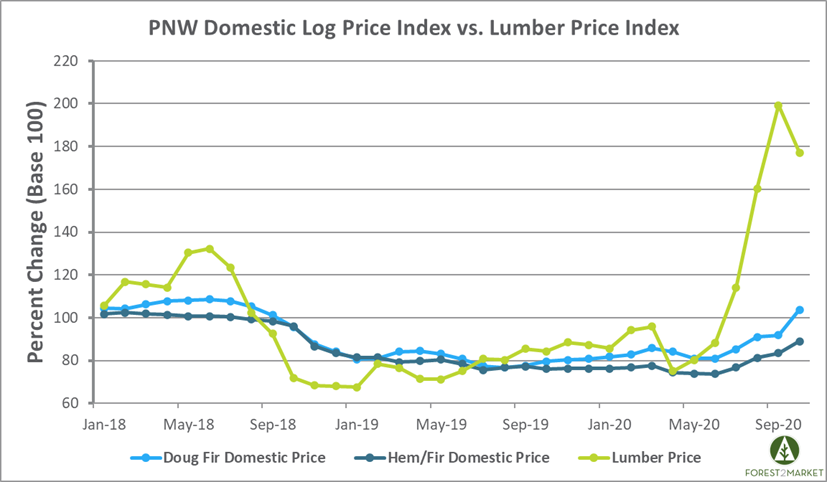

To get a picture of lumber price performance compared to log price performance, we analyzed benchmark softwood lumber products: Doug Fir Green Std&Btr 2x4, Hem/Fir KD Inland Std&Btr 2x4 and WSPF KD #2&Btr 2x4. Prices for all three products have tracked very similarly for the last several years, so we averaged and indexed them along with Doug and Hem/Fir log prices to get a fair, but broad, representation of lumber price performance compared to log price performance in the PNW. (The chart below illustrates a total change in price as a percentage, not a change in actual dollars.)

While lumber prices have come down over the last several weeks, prices are now drifting upwards again and will likely remain at levels on the high side of the historical trend as new housing starts continue to create demand.

Log Exports

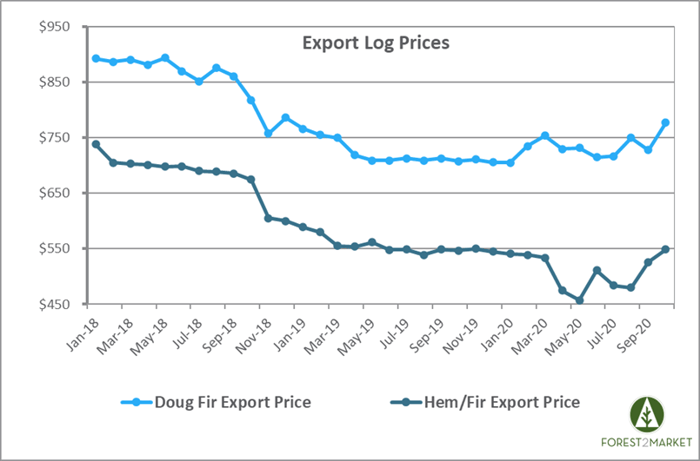

Pacific Northwest log exports are merely a shadow of volumes in recent years. Trade disputes, competitive pricing and ready supplies from Australia and New Zealand have slowed the movement of US logs to China to a trickle. Softwood log export prices to Japan have rebounded in recognition of domestic demand, though volumes have fallen off drastically through 2020.

Export prices for Doug fir and Hem/fir dropped in April as the pandemic really impacted the global market; Hem/Fir export prices dropped over 11 percent. While export values have recently rebounded, those prices are driven by competition with domestic producers due to tight supply.

Outlook

There are few key dynamics to watch in the PNW as we wrap up 2020 and move on to a (hopefully) more stable 2021.

- Lumber prices are still elevated by historical norms and a strong housing market will likely keep pressure on regional mills to perform at capacity. But economic and political uncertainty remains very high, and a second wave of national lockdowns could gut the economic gains we have made in 2H2020. Such a development would have a compounding impact on the labor market, which would likely crush any demand for new housing in the near term.

- The log price data above doesn’t reflect the softening in the market that has recently occurred due to quality concerns and the growing supply of burned logs. While that fear is overblown in some cases, prices for logs have declined slightly. However, I suspect log prices have softened about as much as they can, and that should show up in the November and December data when it is released. It’s been a mild fall and once the rain and snow hit in earnest, deliveries will slow, and supply will tighten - even for burned logs. With improved markets, this will apply upward pressure on log prices during 1Q2021.

- The export market has really fallen off this year and I don’t see that changing in the near term. The China export market has nearly vanished, and most regional export companies remain shuttered due to lack of demand. Domestic and export log prices should temper based on increasing uncertainty in the global market, although tight supplies will ultimately dictate just where those prices will settle.

- Taking a longer view, damage to private forests in western Oregon has been severe. Some localized areas may face decades-long gaps in future timber supply resulting from the fires. Damage to mature timber - which forces early harvest - and the loss of many years of immature growing stock will have serious long-term implications for regional log supply.

Despite the uncertainty associated with the past several months, most regional mills have maintained adequate log inventories, but are now working through salvaged timber and/or actively seeking logs to supply their operations over winter months. Considering the healthy demand for finished lumber and plywood - and their profitable results - it’s still a tightrope walk right now in the Pacific Northwest.

Gordon Culbertson

Gordon Culbertson