After surging 12 percent in August to the highest level since June 2007, US housing starts retreated significantly in September. However, single-family construction rose for a fourth straight month, suggesting that demand is steady and the housing market continues to be buoyed by low mortgage rates despite what appears to be a spooked economy.

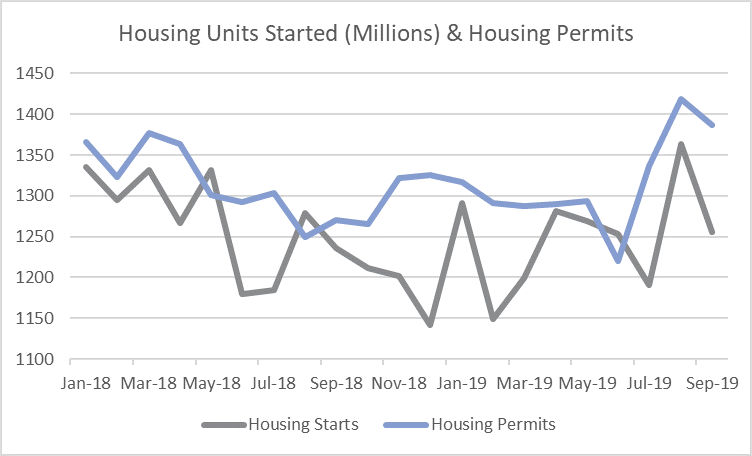

Housing Starts, Permits & Completions

Privately-owned housing starts plunged 9.4 percent in September to a seasonally adjusted annual rate (SAAR) of 1.256 million units. Single-family starts increased 0.3 percent to a rate of 918,000 units; starts for the volatile multi-family segment plunged 28.2% to a rate of 338,000 units in September.

Privately-owned housing authorizations dropped 2.7 percent to a rate of 1.387 million units in September. Single-family authorizations were up 0.8 percent at a pace of 882,000 units. Privately-owned housing completions were down 9.7 percent to a SAAR of 1.139 million units. Per the US Census Bureau Report, seasonally-adjusted total housing starts by region included:

- Northeast: -34.4 percent (+30.5 percent last month)

- South: -4.0 percent (+14.9 percent last month)

- Midwest: -18.9 percent (+15.4 percent last month)

- West: -1.9 percent (+0.0 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: -1.6 percent (-1.7 percent last month)

- South: +7.1 percent (+3.6 percent last month)

- Midwest: -8.3 percent (+8.7 percent last month)

- West: -8.7 percent (+5.3 percent last month)

Home builder confidence jumped three points in mid-October to 71, per the National Association of Home Builders’ (NAHB) index, which is the highest level since February 2018. The 30-year fixed mortgage rate inched down just slightly in September, dropping to 3.61 percent for the month. The rate has now dropped 26 percent since peaking at 4.87 in November 2018. While there are lots of enticing incentives for first-time homebuyers, land/lot shortages and home affordability tend to remain the primary challenges in popular markets.

CNBC added, “Sentiment may be high, but single-family housing starts are rising very slowly. Builders continue to point to higher costs for land, labor, materials and especially regulatory compliance for their slow production as well as for their focus on the move-up and luxury markets. Housing supply is incredibly low, especially at the entry level, and builders are not doing much to replenish that inventory.”

Additional observations from Forest2Market’s most recent issue of the Economic Outlook include:

Two issues are lurking mostly “below the radar” that could negatively affect the housing market. The first involves mortgage re-defaults. Real estate analyst Keith Jurow explains: “In the midst of the housing collapse more than a decade ago, mortgage modifications were rolled out to enable millions of delinquent homeowners to avoid having their home foreclosed.” Since 2007, in excess of 25 million mortgages have been granted either temporary or permanent modifications. A significant proportion of those loans have performed badly, however, with many experiencing multiple modifications and re-defaults. Perhaps unsurprisingly, the propensity to re-default rises with the number of times a mortgage has been modified.

The second issue involves the fiscal health of mortgage underwriters Fannie Mae and Freddie Mac. As part of the federal government taking the entities into conservatorship in September 2008, they received a $190 billion taxpayer-funded bailout. One could be forgiven for expecting that their finances might subsequently be cleaned up, but recent Congressional testimony indicated the “housing finance system is worse off today than it was on the cusp of the 2008 financial crisis.” The two entities together guarantee roughly half of the $10 trillion US home loan market but are allowed to keep a total of only $6 billion ($3 billion each) as a capital buffer.

Given the present arrangement, “Fannie and Freddie are critical to maintaining liquidity in the real estate market,” wrote analysts at Birch Gold Group. “Without these two entities repackaging and guaranteeing mortgages, the sale of homes would be decimated, causing a massive ripple effect across the entire real estate market.”