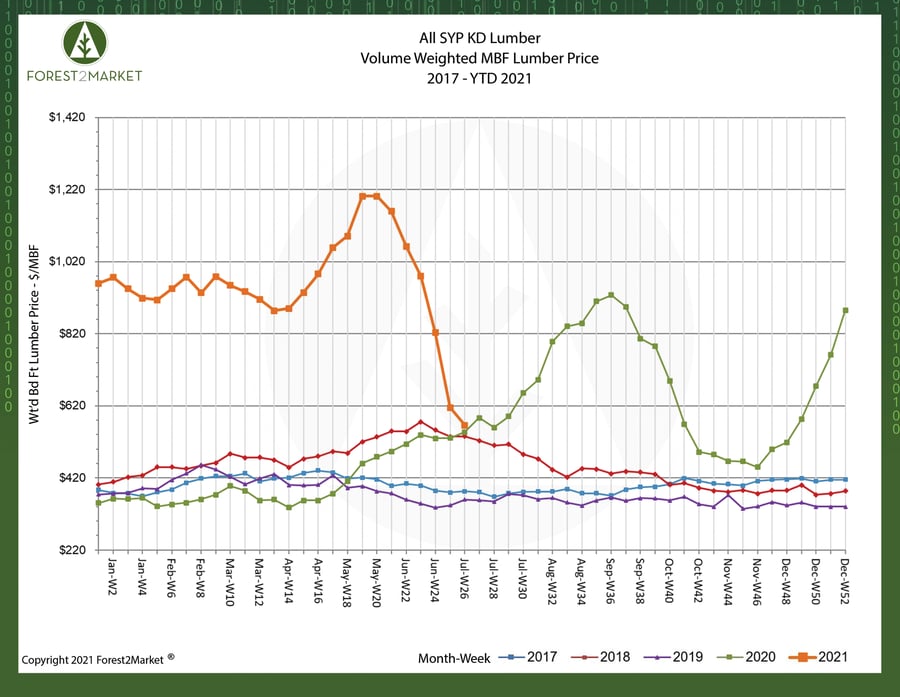

Lumber prices are receding quickly. Per Forest2Market’s southern yellow pine (SYP) lumber price composite, prices recently plummeted for a sixth consecutive week to the lowest point in over seven months.

The weighted average SYP lumber price for the week ending July 2 (week 26) was $566/MBF, which represents a 31% decrease from the previous two-week period. This price change also marks the largest 2-week correction as both a percentage and in dollars (-$257) during the wild lumber market ride that began a year ago. Since peaking in mid-May, prices have now dropped 53%.

Are Lower Lumber Prices on the Horizon?

As some of the air is now being bled out of the inflated lumber market, the obvious question is: Going forward, where will prices settle… or will they settle at all? As the market continues towards equilibrium, there are a few dynamics to watch:

- Home builders have slowed pace; April housing starts declined by more than 9.5%, May starts failed to meet expectations and demand for lumber is waning as the construction sector simply backs off. High costs now threatening to dampen the market going forward; the median new-home price in May was $374,400, up 13% from last May, and the median existing-home price was $356,600, up 24% from last May. I.e., since “first-time and first-generation home buyers are particularly at risk for losing a purchase due to cost hikes associated with increasingly scarce material availability,” enough of them may have decided to give up on buying for now and keep renting.

- Sawmills are incrementally increasing supply as the labor market slowly expands. New capacity in the form of both greenfield mills and existing mill expansions will help meet demand targets.

- In the near term, there are signs that inventories are catching up to demand patterns. During 1Q2021, US softwood lumber production ticked up slightly (+0.6%), US imports jumped 12.4%, and new orders inched down 0.3%. Progress continues to be made in 2Q.

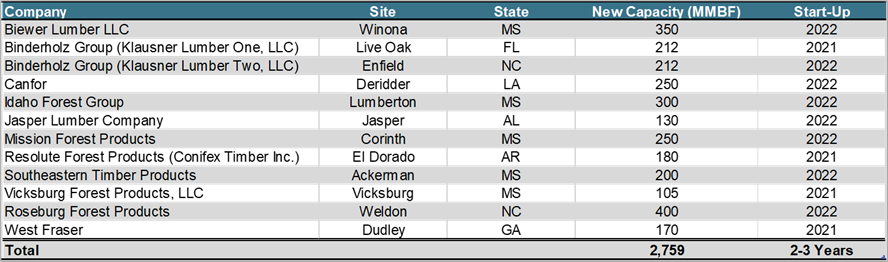

- In the longer term, additional capacity will help establish more surge flexibility in the supply chain. In the US South, nearly 2.8 billion board feet of new lumber capacity is scheduled to come online by the end of 2022.

- Compounding effects from skyrocketing inflation are a real worry both in the near and long terms. As the Harvard Business Review recently wrote, “Nearly all commodity prices rose in the first quarter [of 2021], and most are now above pre-pandemic levels. Food prices are especially concerning; the U.S. Department of Agriculture estimates that food prices have increased 3.5% from 2020 levels. Business leaders must recognize their cost of goods sold (COGS) levels soon will be under pressure (if they aren’t already). Commodity-price inflation has the potential to take the energy out of the rebounding economic market. It may also further split the world into a two-speed recovery: those who are more affluent will be able to accept the increases, while the average citizen will struggle.”

Based on this data, the days of $1,000+/MBF are likely over for now. However, I don’t expect lumber prices to dip to - and remain at – historical levels around the $350/MBF mark anytime soon. It is more likely that the market will settle in a range where prices are still on the high side of the historical norm. Longer term demand patterns also portend a scenario where prices may continue to remain at elevated levels.

Are Higher Timber Prices on the Horizon?

There has been a lot of interest in the disconnect between log and lumber prices over the last year. While the reason behind this disparity is oftentimes perplexing, the reality is that the market for trees is vastly different than the market for lumber. In the US South, the inventory of standing timber has risen unimpeded since the onset of the Great Recession in 2007, which has resulted in an oversupplied market. The surplus of logs combined with improved mill efficiencies has kept log prices suppressed, even as demand for lumber surges and sawmill production continues to increase.

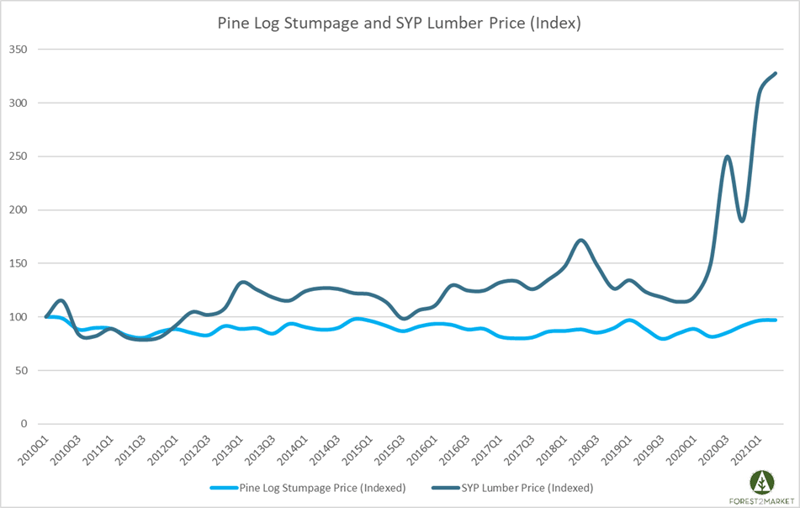

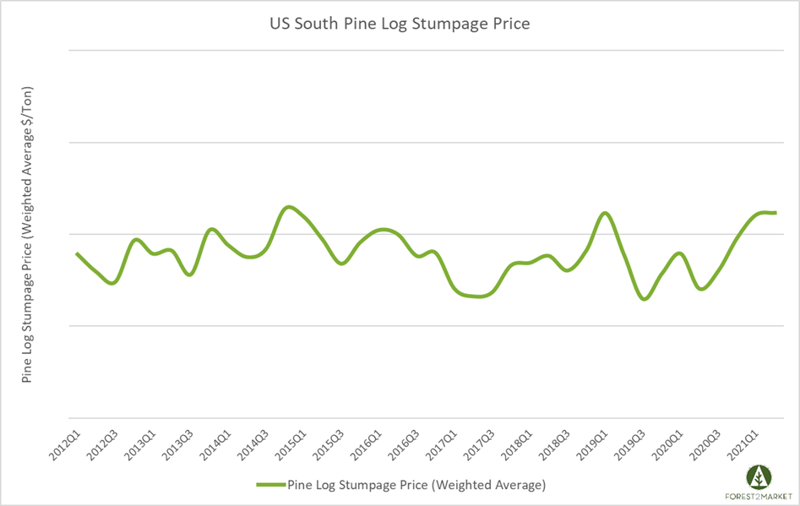

To get a picture of lumber price performance compared to pine log price performance in the South, we indexed weighted average SYP lumber price along with weighted average pine log stumpage price to get a fair, but broad, representation of the two products on a quarterly basis. (The chart below illustrates a total change in price as a percentage, not a change in actual dollars.)

This visual really helps to demonstrate the incredible volatility in the lumber market over the last year. Lumber prices crested in May and have come down over the last several weeks, so it will take some additional time before the reversal will be visible on this quarterly chart.

While not as extreme, the stumpage market has also been volatile as pine log prices have surged 19% since 2Q2020. Prices for pine logs are now at their highest point since 1Q2015.

Will stumpage prices continue to trend higher in 2H2021?

That’s a difficult question to answer at this point. However, based on its deep inventories of wood raw materials, labor pools, competitive operating costs, transportation conditions, haul distances, etc., it is likely that the forest industry in the South will continue to grow and increase its share of global production volumes. Due to the South’s low log costs and deeply embedded forest supply chain, I expect this trend to continue for the foreseeable future. As noted above, nearly 2.8 MMBF of new lumber capacity is scheduled to come online by the end of 2022, which will help reduce the large oversupply of standing timber throughout the South and, in time, the rise in log consumption will begin to affect prices on the stump.

Joe Clark

Joe Clark