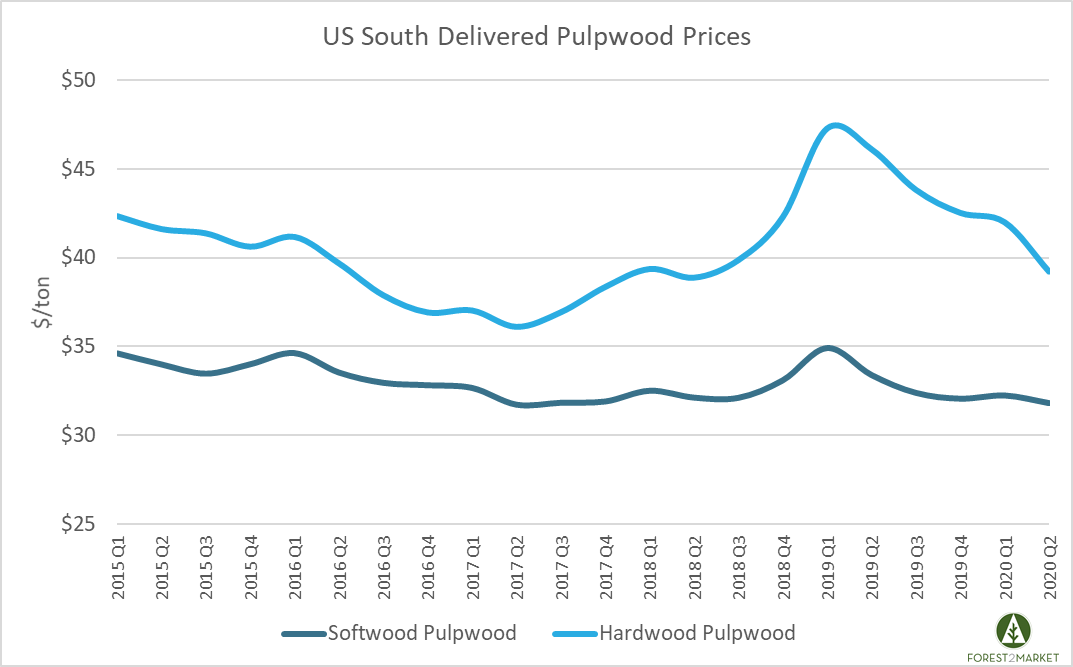

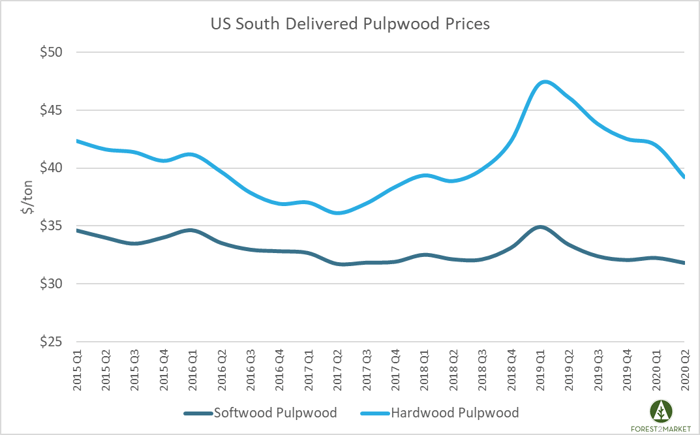

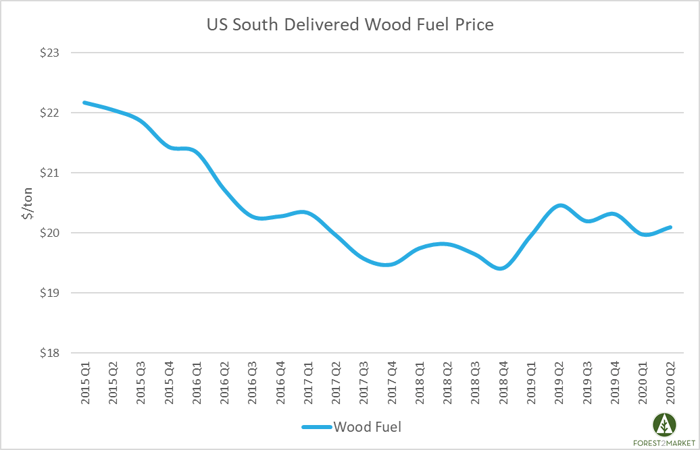

The 5-year delivered price trends for pulpwood and wood fuel in the US South have demonstrated a considerable amount of volatility. Despite these periods of instability, however, all three products have trended lower since 2015.

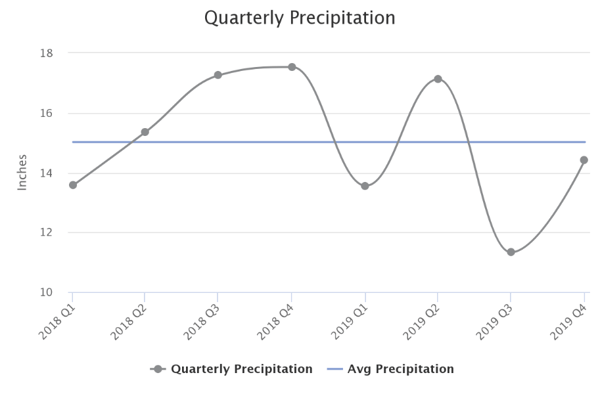

For softwood/hardwood pulpwood and wood fuel, 2019 represented a point of peak volatility over the 5-year period. This was driven in part by the significant amount of precipitation that the South experienced from 3Q2018-2Q2019. With a major swing in rainfall over the 3-quarter period came an equally sizable swing in wood raw material prices as harvesting operations were constrained by the weather.

These are important products in the regional forest supply chain; what can we learn from recent price performance?

Pulpwood Products

Year-Over-Year

Year-over-year (YoY), delivered prices for both pine pulpwood and hardwood pulpwood in the US South decreased (2Q2019 to 2Q2020).

Delivered pine pulpwood prices reached a 5-year high in 1Q2019 at $34.91 per ton; however, prices quickly dropped just a quarter later. On a YoY basis, pine pulpwood prices were down $1.59 per ton (4.8 percent) to $31.79/ton in 2Q2020 vs. $33.38/ton in 2Q2019.

Delivered hardwood pulpwood prices also reached a 5-year high in 1Q2019 at $47.26 per ton, and they too reversed course a quarter later. On a YoY basis, hardwood pulpwood prices were down $6.87 per ton (15.0 percent) to $39.22/ton in 2Q2020 vs. $46.09/ton in 2Q2019.

Quarter-Over-Quarter

Quarter-over-quarter (QoQ), delivered prices for pine pulpwood and hardwood pulpwood in the US South decreased as well (1Q2020 to 2Q2020). Pine pulpwood prices decreased $0.43/ton, or 1.3 percent to $31.79/ton in 2Q2020 vs. $32.22/ton in 1Q2020. Hardwood pulpwood prices decreased $2.77/ton, or 6.6 percent to $39.22 in 2Q2020 vs. $41.99/ton in 1Q2020.

2H2020 Outlook

In 2H2020, we expect pine pulpwood delivered prices to slowly begin trending higher due to seasonality and an uptick in demand. Prices were suppressed in 2Q due to the extreme uncertainty associated with the COVID-19 pandemic. As a response, the lumber industry instituted widespread curtailments, which cut the supply of residual chips available to the market. But as the economy further opens up and manufacturing comes back online, demand for pine residual chips and pulpwood will increase.

Conversely, we expect hardwood pulpwood to continue trending down as it has for the last four quarters as demand has waned. Hardwood pulpwood is largely a byproduct of pine sawtimber harvest activity; as pine sawtimber supply has flattened (or decreased in some areas) in response to deteriorating economic conditions, so too has hardwood pulpwood supply. While this condition historically pushes prices higher, demand for this product in the larger market is trending down.

Wood Fuel

Year-Over-Year

Year-over-year, delivered prices for wood fuel in the US South decreased slightly (2Q2019 to 2Q2020). Delivered wood fuel prices demonstrated a 5-year high at the beginning of the period in 1Q2015, at $22.17 per ton. On a YoY basis, wood fuel prices were down $0.36 per ton (1.8 percent) to $20.10/ton in 2Q2020 vs. $20.46/ton in 2Q2019.

Quarter-Over-Quarter

Quarter-over-quarter, delivered prices for wood fuel increased by $0.34/ton, or 0.6 percent, to an average of $20.10/ton in 2Q2020 vs. $19.98/ton in 1Q2020.

2H2020 Outlook

Wood fuel prices will likely face downward pressure in the second half of the year as sawmills ramp up production after temporary curtailments in response to COVID-19, as well as continued strong demand for pulpwood. The combination of these factors will push the supply of wood fuel higher, which will likely have a dampening effect on prices.

Joe Clark

Joe Clark