3 min read

SYP Lumber Prices Deflate in 2019; What’s in Store for 2020?

John Greene

:

January 13, 2020

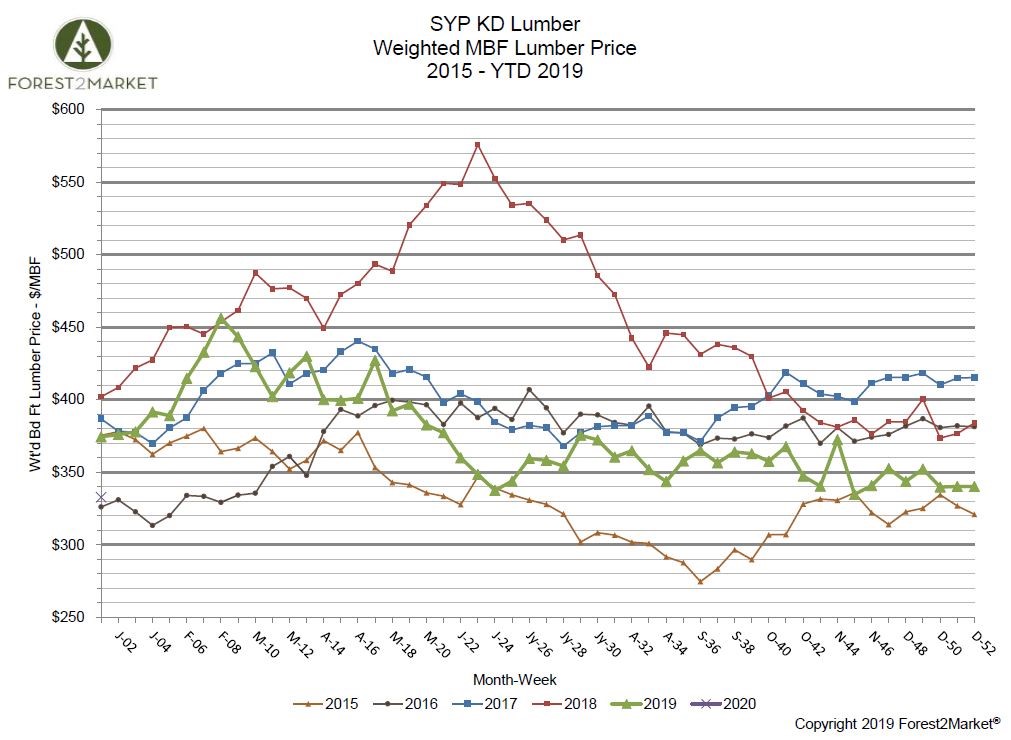

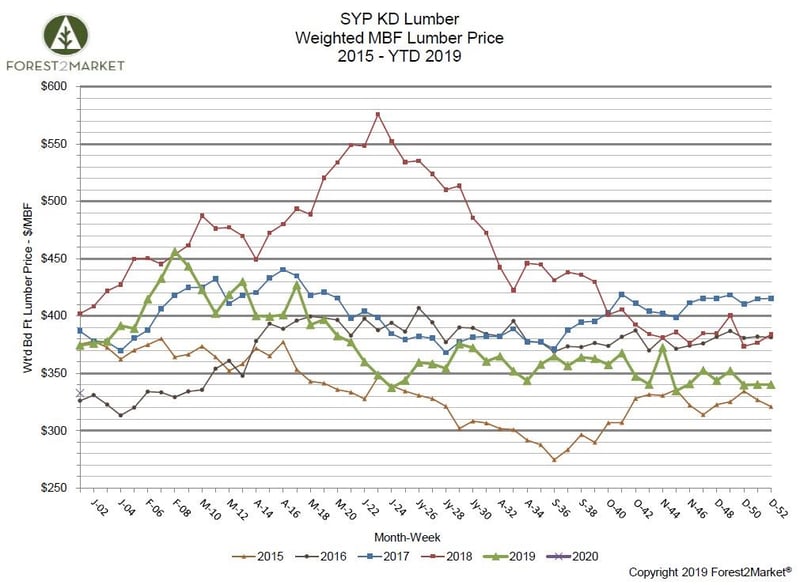

2019 is now in the books and after 12 months of moderate volatility, southern yellow pine lumber prices finished the year with a whimper.

While US housing starts showed signs of life in 4Q2019, the segment is not close to returning to the historical average (1.5 million starts/month), and Forest2Market’s southern yellow pine (SYP) composite prices illustrate this challenge.

In fact, a recent article published by Canadian Forest Industries provides a concise description of the larger North American softwood lumber market over the last two years:

“In North America at least, 2019 will be remembered as the hangover from the 2018 first-half price spike that collapsed, leaving many casualties along the way. Various Wood Markets Monthly issues in 2019 highlighted the sawmill devastation in British Columbia, the dismal global softwood lumber consumption trends in 2018 and 2019, and the emergence of a new low-cost timber supply in central Europe that is quickly changing global markets.”

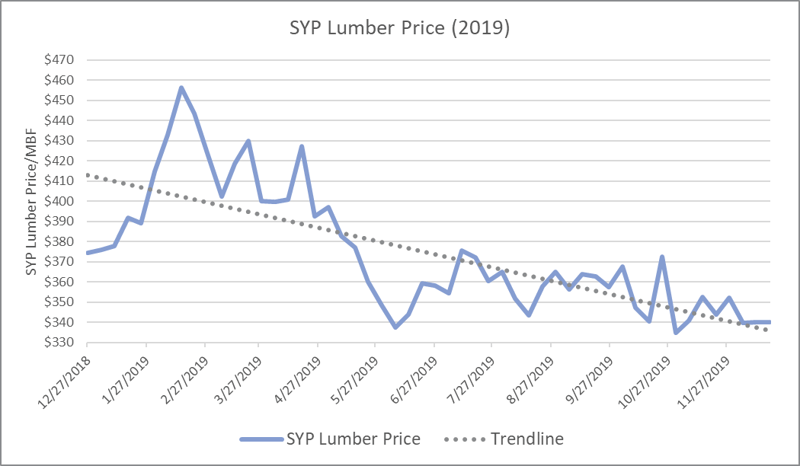

SYP lumber prices finished 2019 at their lowest point since 2015. Forest2Market’s composite SYP lumber price for the week ending January 3 (the final week of 2019) was $340/MBF, which is an 11.5 percent decrease from the same week in 2018. Prices decreased incrementally by quarter during 2019:

- 1Q2019 Average Price: $410/MBF

- 2Q2019 Average Price: $379/MBF

- 3Q2019 Average Price: $361/MBF

- 4Q2019 Average Price: $348/MBF

- 2019 Average Price: $375/MBF

A more detailed look at price performance since the beginning of 2019 shows periods of increased volatility but more importantly, a steady decreasing price trend. The trend line since January is flanked by both peaks and valleys, however, the descending movement is apparent.

Canadian Forest Industries also highlighted a topic that Forest2Market has emphasized for years, adding that, “All these themes have one thing in common: gaining competitiveness in volatile markets where low-cost suppliers set the market and high-cost producers get wiped out quickly.”

The global market is increasingly influenced by downward price pressure due to an expanding portfolio of low-cost suppliers. The only way to maintain profitability in the coming decade is to find competitive advantages.

How can mill managers improve supply chain efficiencies?

- Centralized Purchasing Programs: Over the last decade, the ownership of the SYP industry has changed dramatically. Today, after a 10-year acquisition spree, there are five companies who (combined) own more than 70 mills and control over 60 percent of the lumber production capacity. In this situation, those large companies can implement a coordinated log purchasing program across their broad procurement region. The result can increase the efficiency of logging and hauling operations, allocation of logs to specific mills, and mitigate volatility in stumpage and delivered log prices.

- Precise Log Market Data: Rather than relying on guesswork or surveys to take a sample of log prices, Forest2Market has established a stumpage and delivered log cost price benchmarking reporting service. The prices reported are based on millions of actual transactions that provide the most precise pricing data in the industry.

- Use of Middlemen: Log procurement has evolved with heavy use of “dealers” who are essentially middlemen that consolidate logs from multiple small private owners into larger volumes for more efficient, higher volume transactions with mills. Savings opportunities exist for savvy procurement teams.

- Sawmill TQ: A partnership between The Beck Group and Forest2Market, Sawmill TQ is a digital product that includes key metrics such as manufacturing cost, productivity, staffing, yields, product mix and log costs, which are all benchmarked and delivered via the SilvaStat360 portal. The fresh, accurate, and representative mill operation data delivered by this new tool helps SYP mills drive efficiency in their supply chains, improve performance, and maintain relevance and competitiveness in a dynamic global market.

2020 Southern Yellow Pine Outlook

The lack of price movement during most of 4Q2019 seems to reflect the general apprehension in the market as a series of economic and political factors intensify a sense of uncertainty — all of which influences the housing sector and demand for softwood lumber. There are plenty of “unknowns” on the table right now, including:

- A largely unresolved US/China trade war

- A continuation of the US/Canada softwood lumber dispute

- European beetle infestation that is killing spruce inventory and flooding the domestic and export markets with salvaged logs

- Other significant and unresolved geopolitical concerns:

- Current tense military standoff with Iran

- Continued tension with North Korea

- Brexit

- A highly contentious presidential election year

- Low US lumber prices — the lowest they’ve been in four years

Joe Davis, global chief economist and head of investment strategy at Vanguard, is skeptical about the near term performance of global markets, which would impact the larger housing sector and future lumber/panel demand.

“In the year ahead, we don’t foresee a significant reversal of the [U.S.-China] trade tensions that have occurred so far. And with continued geopolitical uncertainty and unpredictable policy-making becoming the new normal, we expect that these influences will weigh negatively on demand in 2020 and on supply in the long run.”

Davis also said US growth will slow to roughly 1 percent next year, and China’s growth performance will also be below trend.

Forest2Market’s forecast is not quite as conservative, but we also look for some pullback in key sectors.

While implementation of the US-Mexico-Canada trade agreement—which now appears more likely—and a possible trade deal with China present upside risk to the projections, we think US growth will decelerate in 2020—GDP growth will average +0.9 percent—and the housing market will reflect this weakness. Total housing starts will fluctuate between SAARs of 1.103 and 1.351 million units, with 2020’s average being 1.264 million units (+0.6 percent relative to 2019).

No one has a crystal ball to tell us where the industry will go after a discouraging 2019, but transaction-based historical data and forecasting tools can help ensure profitability and inform your decisions as we enter the new year.