4 min read

Winter Precipitation Trends: Will Timber Prices be Impacted?

John Greene

:

February 13, 2020

Winter weather challenges have the potential to suspend harvesting operations in every wood basket in North America. Prolonged wet weather in the South results in inoperable conditions for harvesting crews; warm winter temperatures in the Northeast and Lake States also keep crews sidelined; and while harvesters in the Pacific Northwest (PNW) can work pretty effectively through wet weather, hauling can become an issue.

Sound planning and inventory preparedness at the mill level are therefore key to surviving the winter months while mitigating risk exposure.

How is winter weather shaping harvesting conditions in 1Q2020, and can it give us any indication into the directional price of timber in the near term?

Pacific Northwest

The PNW Kicked off 2020 in a dry spell. As Courtney Flatt recently wrote for Oregon Public Broadcasting (OPB), “At the start of 2020, the snowpack situation looked dismal. After a dry start to the season, Washington and Oregon had less than half the amount of snow they’d normally see in the mountains. The amount of water in Washington’s snowpack measured at 48% of normal; Oregon’s was 45%.”

But, as most of the country can attest since the beginning of the year, Mother Nature can change on a dime. Flatt continued, “Then came the first few weeks of January. Washington’s snowpack is now at 98% of normal; Oregon’s is 97%. Idaho has normal amounts of snowpack, with more than normal amounts of snow in the northern panhandle. National models show February could be colder than normal for the region.”

Domestic Doug fir and Hem/fir log prices in the PNW have largely flattened over the last 6-8 months—especially in the wake of record highs experienced during 2018. North American lumber prices also peaked during that time and they, too, have largely corrected course.

With “normal” winter weather in store for most of the PNW, we expect minimal log price movement for the domestic market in the near term. The export market seems even more pinched at present than it was a year ago; the coronavirus outbreak combined with unsettled Chinese trade issues have caused a great deal of uncertainty for exporters.

Eastern North America

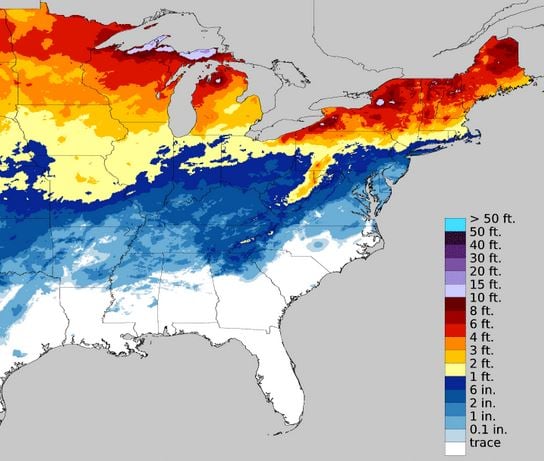

While much of the snowfall across the Lake States and Northeast regions has come later in the season, many areas have caught up with historical averages in the wake of recent snowstorms—and more snow is on the way. The National Weather Service in Milwaukee just noted that “… we are above normal snowfall for the season through Feb. 10th. Milwaukee: 32.2" so far, normal: 31.6". Madison: 43.4" so far, normal: 34.5.” Snow totals in heavy timber harvesting areas such as Duluth, MN are average, while totals in the Upper Peninsula region of MI are roughly 10-20% above average.

Areas of Maine and New Hampshire have been battered with snowstorms; regions across northern Maine just received 18” and, like the Lake States, more is on the way.

Snowfall Accumulation (to 2/11/2020) Source: National Oceanic and Atmospheric Administration Snowfall Analysis

Source: National Oceanic and Atmospheric Administration Snowfall Analysis

While such storms can temporarily delay road travel, these sustained periods of cold weather are ideal for timber harvesting crews across Eastern North America, which should result in a steady supply in the near term. However, as we noted earlier in the week, inventory levels are low compared to the last few years across the region.

When analyzing days of inventory and price over the last several months, a trend is developing that is worth monitoring: market onsite days of inventory have been in the low to mid-30s over the last several months—a seasonal period where mills typically maintain levels in the upper 40s and 50s. Market offsite days of inventory have been equally thin. We’re now beginning to see an increase in price in combination with low inventory levels, which is a situation procurement teams in the region hope to avoid at all costs.

US South

Many areas within the southern wood basket appear to be headed for a repeat of winter 2019, as relentless rain and flooding continue to pound the region. As Accuweather recently reported, “Many area rivers, creeks and streams are still running well above average compared to historical norms across the South and Southeast. According to the USGS WaterWatch, a number of gauges are recording water levels near or above the 90th percentile for this time of year.”

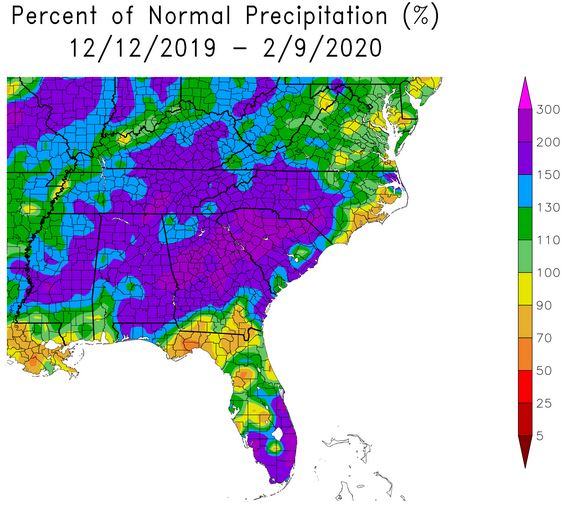

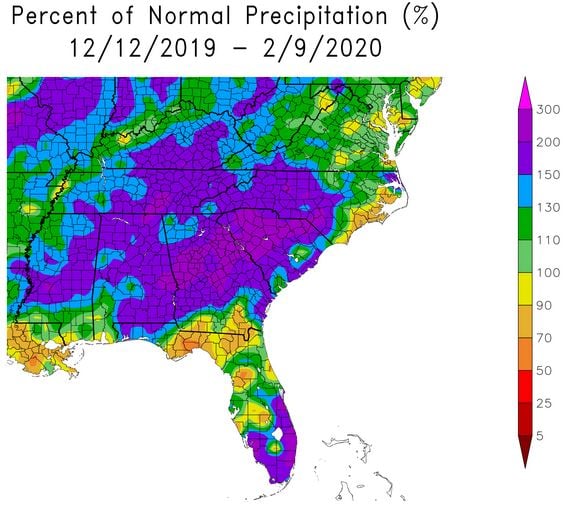

A highly-volatile band of destructive storms that stretched from Mississippi to the Carolinas recently brought tornados and localized flooding of over 8” to an already-waterlogged region. Many of the timber-heavy portions of the South have already received roughly 200% of normal precipitation, and more rainfall is on the way.

Source: The Southeast Regional Climate Center

Source: The Southeast Regional Climate Center

Southern timber prices largely corrected course in 4Q2019 after a year of significant volatility that was also driven by an abnormally wet winter in 2019. Like last year, much of the region’s timberland is simply too wet to work at the moment, which could result in pockets that will experience a temporary spike in stumpage prices in the near term.

Like last winter, the early signs are that prolonged wet weather is driving southern timber prices higher in 1Q2020. As a reaction to harvesting restrictions, hardwood products typically experience the first increase in price followed by pine, which is easier to access in soggy conditions.

While we can’t control the weather or the broader economy, southern timber buyers and sellers can make better decisions by accessing the historical price data, trends and timber sales details available in Stumpage 360.

1Q2020 Outlook

Domestic timber supply and inventories in the PNW are secure and the weakening export market will free up even more fiber for regional mills in the near term. In the absence of an uptick in demand from the housing sector, we look for log pricing to stabilize into 2Q.

With more than a few weeks to go of potential winter weather, there is an increased supply side risk in Eastern North America in the near term. Since inventories are already low in the Lake States and Northeast, this is a dynamic that regional mill facilities must monitor in the coming weeks to avoid a scramble to secure fiber at significantly higher prices.

Like last winter, the US South is underwater in many areas and while inventory levels are adequate, supply risks are a concern. Timber purchasers spent most of 2019 working tracts that were bought prior to the rainfall of 1Q2019, which begs the obvious question: Are timber purchasers now buying stumpage in a largely unworkable market, and will they find themselves in a pinch for fiber by 2Q? If there is enough demand at just the right time, prices will surge like they did last year.